-

A fifth of respondents have reduced pension payments already, while two fifths are reducing their savings or investments pots

-

Temporary pauses in pension contributions for just three years could impact future pension pots by nearly £60,000 for a 30-year old worker

07 September 2023, London – New research from M&G Wealth finds that savers are reducing their pensions contributions to deal with the cost-of-living crisis, creating big reductions in their expected retirement pots. A fifth (20%) of savers surveyed have either reduced or stopped contributing to their workplace pensions in direct response to the cost-of-living crisis, which could be hitting their end pots by over a quarter of a million pounds. Of those with private pensions, almost a quarter (23%) have reduced or stopped contributions.

As the UK’s Pensions Awareness Week kicks off next week, M&G Wealth’s upcoming Family Wealth Unlocked report – a survey of 2,000 UK adults [who are receiving financial advice] – shows that UK savers scaling back their pension contributions to deal with the rising cost of living are potentially missing out on attractive tax breaks and the benefits of compounding, which could result in significantly smaller pots in retirement. The trend is consistent across those with both private pensions and workplace pensions, with decreasing contributions to the latter being particularly damaging long-term given typical workplace matching schemes.

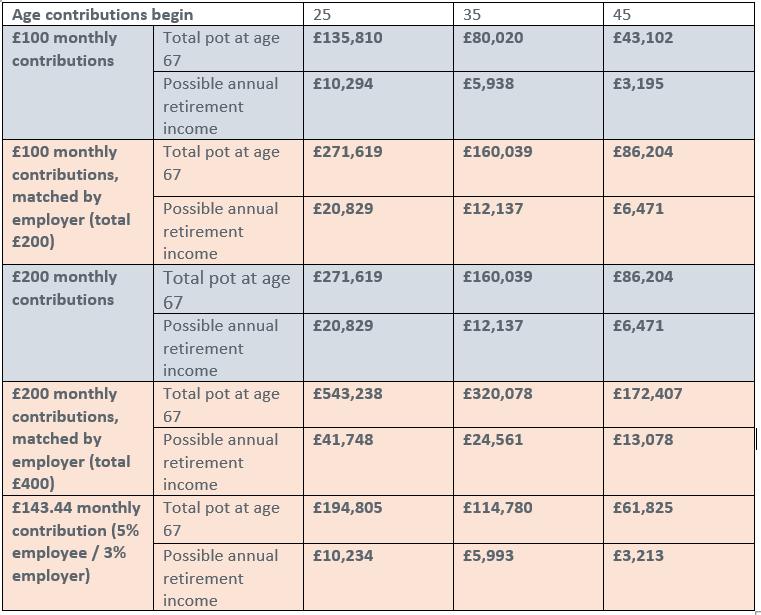

Additional data from M&G Wealth data shows that individuals reducing their monthly workplace pensions contributions from £200 to £100 could cost them up to £271,619 in their total pension pots, or a difference of £20,919 in annual income - a reduction in monthly income from £3,479 to £1,735.751. For those looking to increase short-term money by temporarily halting payments for a 3-year period before increasing back to previous levels, it would still cost them up to £59,158 in retirement2.

For adults earning the average UK salary of £27,756 a year contributing the minimum auto-enrolment amount per month (£143.44), temporarily halting contributions for three years at aged 30 could impact their final pot by £21,7923, a pot of £173,013 compared to a pot of £194,805 if they continue contributions at current levels.

Table to demonstrate potential final retirement savings and annual income from various contribution rates

1Calculations by the Prudential Retirement Modeller, assuming a 25-year old halves their contributions from £200 to £100, which is matched by their employer, and remains at this level of contributions until the age of 67, and has a life expectancy of 87 years old

2 Calculations by the Prudential Retirement Modeller, assuming a 30-year old who has been contributing £200 into pension since 25 which is matched by an employer, stopping payments for three years, before returning to £200 p/m contributions. Assuming retirement age of 67

3 Calculations by the Prudential Retirement Modeller, assuming the average UK salary of £27,756, employee contribution of 5% and employer of 3%, until the age of 67

Kirsty Anderson, Pension Specialist at M&G Wealth, said: “The cost-of-living crisis is continuing to place a strain on people’s bank balances, and many are having to take action to free up more cash for the here and now. However, while reducing pensions contributions might seem like a quick fix to free up money, savers need to be aware of the financial implications this could have for them later in life. Pensions are one of the most efficient and lucrative forms of saving, especially for those in companies with an employer-matching scheme, meaning there might be better ways of raising short-term funds. Our data shows that even taking a short break from your contributions could have a significant impact in retirement.

“In an environment where every penny counts, savers should equip themselves with as much information as possible before making changes – from the use of free online tools to the services of a financial adviser for those with bigger pots of money.”

In addition to pension contributions, the survey found that almost two fifths (37%) of respondents have reduced their savings or investments, and a further 27% of people plan to do so by next May. The primary drivers of concern were the rising cost of living and interest rates, with 84% of respondents worrying about inflation, and 72% are concerned about rising interest rates. 30% have also reduced spending on financial advice and a further 23% will reduce spending on advice before May 2024.

Half of those surveyed (50%) have reduced their spending on everyday luxuries like coffee, eating lunch out, and magazines, and 44% have reduced the amount they spend on their weekly food shop, as shopping basket prices remain high.