2008-09 |

2009-2010 |

2010-11 |

|

|---|---|---|---|

Pension Inputs |

£20,000 |

£60,000 |

£60,000 |

Standard AA |

£50,000 |

£50,000 |

£50,000 |

Unused AA to carry forward |

£30,000 |

Nil |

Nil |

Total carry forward (cumulative) |

£30,000 |

£30,000 |

£30,000 |

Pensions

Pension annual allowance carry forward explained

Last Updated: 6 Apr 25 17 min read

Contents

1. Key Points

2. What is carry forward and when is it used?

4. Transitional aspects – special rules for 2008/9 to 2010/11

Key Points

- Annual allowance rules operate separately from the tax relief rules. You need to consider both when looking at pensions saving

- Carry forward relates only to unused annual allowance (not tax relief from earlier tax years) and does not need to be ‘claimed’

- Carry forward is only used where pension input amounts exceed the standard AA or individual’s tapered AA limits for the relevant tax year

- Pension Input Periods prior to 6 April 2016 did not have to be aligned with the tax year, and did not change retrospectively

- To uncover unused AA for carry forward, you should go back 3 years (but not beyond the date of first joining a pension scheme) from any AA excess year

What is carry forward and when is it used?

Pension annual allowance (AA) is the annual limit on the amount of contributions paid to, or benefits accrued in, a pension scheme before the member has to pay tax.

Carry forward is a potential way of increasing a member’s annual allowance in the tax year.

Carry forward is used when a member’s total pension input amounts for a tax year exceed their annual allowance limit for that year.

Carry forward of unused annual allowance from earlier tax years may allow a member to absorb or reduce any annual allowance excess paid in the current tax year which, in turn, would reduce any potential annual allowance charge amount.

Carry forward

Carry Forward of unused allowance was introduced for tax years 2011/12 onwards, coinciding with the first reduction in Annual Allowance.

It allows those who use up the Annual Allowance in any particular tax year to carry forward any unused allowance from the previous 3 tax years. Those who have triggered the Money Purchase Annual Allowance (MPAA) cannot carry forward to increase the MPAA limit for post trigger date defined contributions in any tax year. However, carry forward can still be used where the tapered annual allowance (TAA) applies for any tax year on or after 2016/17.

PIPs from 6 April 2016

The transitional arrangements implemented in the 2015/16 tax year (explained later) have resulted in all pension schemes having a Pension Input Period that is aligned with the tax-year (6 April to 5 April), and there is no longer the opportunity to change the PIP period. As such from 6 April 2016 it is the contributions (money purchase schemes) or benefit accrual (defined benefit schemes) within the relevant tax year that will be measured against the relevant Annual Allowance, which considerably simplifies the calculation of the Pension Input Amount for AA assessment.

Anyone who is eligible can carry forward any unused annual allowances from a tax year in which they were a member of, or joined, a UK registered pension scheme. This is a very broad rule. ‘Member’ includes:

- Active: currently accruing/ building up benefits in the scheme, paying individual contributions or receiving contributions on their behalf, for example, from an employer or any other third party

- Deferred: has a paid-up fund, or a right to receive pension benefits at a later date

- Pensioner: receiving payment of benefits from the scheme, such as a scheme pension

- Pension credit: member has received a pension credit (following a divorce and as directed in a pension sharing court order)

Does this include someone in receipt of pension income from a lifetime annuity?

Please note

Once benefits are flexibly accessed it is not possible to use carry forward to increase the limit of the money purchase annual allowance. Therefore this section is in relation to a lifetime annuity that is only allowed to reduce under circumstances prescribed before 6 April 2015.

An individual receiving income from an annuity policy may be a member of the scheme, but this depends on how the annuity policy is set up.

If the annuity policy is in the name of:

- the pension scheme trustees, the pension is regarded as being paid under the pension scheme and the individual is a pensioner member.

- the individual and was set up as a deferred annuity that automatically became a registered pension scheme, this means the individual is a pensioner member - as the annuity policy is itself a registered pension scheme.

- the individual but it is not a registered pension scheme, this means the individual cannot be a pensioner member nor a pension scheme member. However, it is unlikely that HMRC would have intended any annuitant to be treated more restrictively than a pensioner member simply because of the way their contract was set up.

So, in summary, where a lifetime annuity has been purchased using registered pension scheme funds (it is not a Purchased Life Annuity), the annuitant could use carry forward but not to increase the MPAA if this applies.

PTM025400

Does this include a member of a non-UK pension scheme?

Where a client was not a member of a registered pension scheme but was a member of a non-UK pension scheme it is important to find out if they satisfy the definition of a currently-relieved member of a currently-relieved non-UK pension scheme. If they do, they are eligible to use carry forward. More information can be found in the Pensions Tax Manual.

PTM113310

Points to note

Where a client has a rebate-only personal pension plan this makes them eligible to use carry forward. Or they may have joined an occupational pension scheme when working for an employer many years ago. Regardless of how long ago they left service, if they remain a deferred member in the scheme they are eligible to use carry forward. Just to clarify, there is no requirement that they could actually have paid any further contributions to the existing scheme.

Also, there is no need:

- To have had a Pension Input Period (PIP) ending in that tax year, or

- For contributions/accrual in that tax year, or

- To have had relevant earnings in that tax year, or

- To have been living in the UK in that tax year.

There is a case for joining a pension scheme, even with a nominal contribution, as early as possible. In a scenario where you have someone starting out as a self-employed worker, or setting up their Ltd Company, during the early years funding a pension is probably far from their mind. But what about when they are making good money? If they have not been a member of a pension scheme previously, they cannot use carry forward. The rules state you must have been a member of a pension scheme in the year you are looking to carry forward from.

Even contributing £10 to a pension, which costs the self-employed £8 (assuming they are basic rate taxpayers) and Ltd Company £8.10 (assuming it’s an employer contribution) opens up possibilities for multiple years annual allowances to be used in future, rather than limiting this to one year’s AA where they haven’t previously joined a pension scheme.

The carry forward facility applies on a rolling 3-year basis, so for:

- 2011/12 allows use of unused allowance from 2008/09, 2009/10 and 2010/11

- 2012/13 allows use of unused allowance from 2009/10, 2010/11 and 2011/12

- 2013/14 allows use of unused allowance from 2010/11, 2011/12 and 2012/13

- 2014/15 allows use of unused allowance from 2011/12, 2012/13 and 2013/14

- 2015/16 allows use of unused allowance from 2012/13, 2013/14 and 2014/15

- 2016–17 allows use of unused allowance from 2013/14, 2014/15 and the pre–alignment tax year (capped at £40,000 and less post-alignment inputs)

- 2017–18 allows use of unused allowance from 2014/15, the pre-alignment tax year 2015/16 (capped at £40,000 and less post-alignment inputs) and 2016/17

- 2018–19 allows use of unused allowance from the pre-alignment tax year 2015/16 (capped at £40,000 and less post-alignment inputs), 2016/17 and 2017/18

- 2019/20 allows use of unused allowance from 2016/17, 2017/18 and 2018/19

- 2020/21 allows use of unused allowance from 2017/18, 2018/19 and 2019/20

- 2021/22 allows use of unused allowance from 2018/19, 2019/20 and 2020/21

- 2022/23 allows use of unused allowance from 2019/20, 2020/21 and 2021/22

- 2023/24 allows use of unused allowance from 2020/21, 2021/22 and 2022/23

- 2024/25 allows use of unused allowance from 2021/22, 2022/23 and 2023/24

- 2025/26 allows use of unused allowance from 2022/23, 2023/24 and 2024/25

Where the annual allowance is exceeded in a tax year it is the unused allowance from the earliest year that is used first. If you are looking to maximise carry forward, you would go back three years (but not beyond the date of first joining a pension scheme) before the current tax year and if there is an AA excess in any of those years, three years before that AA excess year, which may mean going right back to 2008/09, to uncover unused AA for carry forward.

Where a Tapered Annual Allowance (TAA) applies in a tax year (TAA was introduced from tax year 2016/17 and you can read more about this in our Tapered Annual Allowance article), it is only the unused TAA amount that can be carried forward from that tax year. Having a nil pension input amount does not mean you carry forward the full standard annual allowance. For high income clients, you still need to work out any TAA limit before you can calculate available carry forward of unused annual allowance.

Transitional aspects – special rules for 2008/9 to 2010/11

Even though tax years 2008/09 to 2010/11 inclusive are before the rule changes, the calculation of unused allowances is based on the existing rules, so:

- The annual allowance is £50,000

- Any defined benefit or cash balance accruals are based on a factor of 16 instead of 10, with some inflation proofing

- In a year when retirement benefits are taken, any pension contributions made will be assessed against the annual allowance

One departure from the existing rules was announced by HMRC on 25 November 2011. They updated their guidance to reflect that it is only annual allowance excesses from tax year 2011/12 onwards which use up unused allowance under the carry forward rules.

In practical terms, this means that for carry forward calculations involving 2008/09 to 2010/11 inclusive total inputs should be capped at £50,000.

Example:

Find out more on the HMRC website.

Special rules for 2011/12

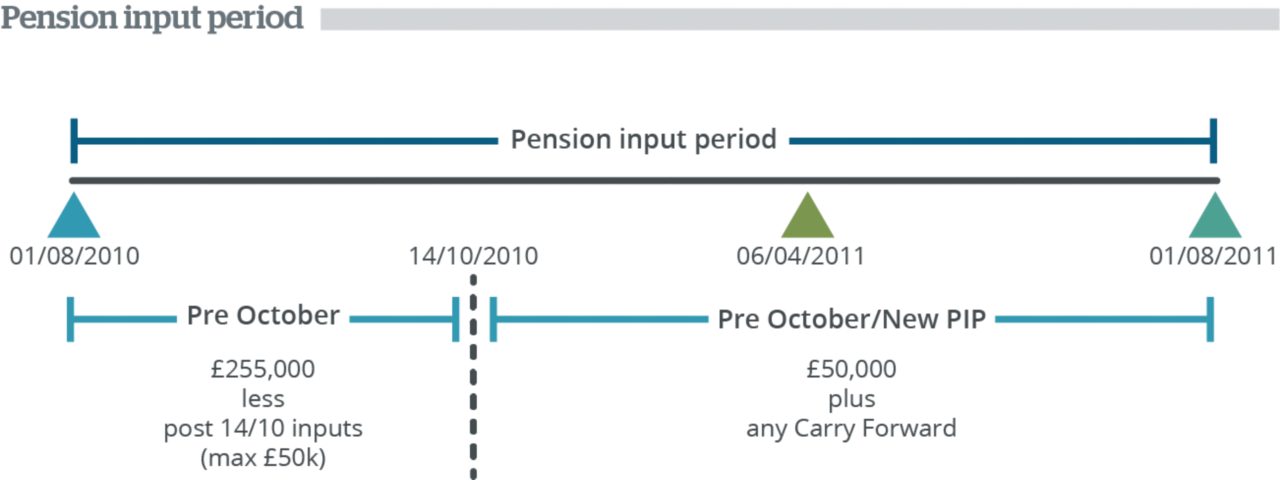

When the Government issued its draft legislation on 14 October 2010 (reducing the annual allowance for 2011/12 to £50,000) many pensions input periods would have started and be ending in 2011/12 with an expectation of at least a £255,000 Annual Allowance.

Aware that some people would have been funding for amounts in excess of the reduced Annual Allowance the Government laid transitional rules which brought about the creation of the ‘straddling pension input period’.

These directly impacted the:

- Amount of annual allowance available for PIPs ending in 2011/12, and

- Use of unused allowance from previous tax years

Straddling Pension Input Periods

A straddling pension input period is one that commenced prior to the 14th October 2010 and ends in the 2011/12 tax year where total inputs for PIPs ending in 2011/12 exceed £50,000.

Where there are straddling pension input periods the calculation identifying any annual allowance excess needs to be broken down.

Step one

All PIPs are broken into pre announcement periods and post announcement periods.

The pre announcement periods are:

- From the start of the straddling PIPs until 13 October 2010

The post announcement periods are:

- Straddling PIPs from 14 October until the end of the straddling PIP, and

- Any other PIPs starting post 14 October 2010 until their end date on or before 5 April 2012.

Step two

Calculate total inputs for every post announcement period.

Step three

Deduct £50,000 from the amount in step 2. The result is an annual allowance excess. If result is negative there is no AA excess.

Step four

Calculate total inputs for every pre announcement period. N.B. any defined benefit or cash balance accrual is measured using the previous factor of 10 not 16.

Step five

Calculate the pre announcement ‘allowance’ by deduction from £255,000 the lower of:

- £50,000, and

- the post announcement total inputs (from step 2)

Step six

Subtract the pre commencement ‘allowance’ from the total pre commencement inputs. The result is an annual allowance excess. If result is negative there is no AA excess.

Step seven

Add together the pre and post announcement excesses (step three plus step six).

Where the total amount of excess exceeds the available carry forward amount then there is an annual allowance charge for 2011/12.

Example of straddling pension input amounts

Pre announcement total |

Post Announcement Total |

Commentary |

|---|---|---|

£205,000 |

£50,000 |

There is no excess amount as both amounts are within their respective allowances |

£215,000 |

£50,000 |

There is a £10,000 excess ‘pre’ as the allowance is £ 255,000 - £ 50,000 = £ 205,000 |

£215,000 |

£40,000 |

There is no excess as the ‘pre’ allowance is £ 255,000 - £ 40,000 = £ 215,000 |

£215,000 |

£60,000 |

There is a £10,000 excess ‘pre’ as the allowance is £255,000 - £50,000 = £205,000 |

PIPs prior to Summer Budget 2015

Prior to the Summer Budget on 8 July 2015 each pension arrangement would have had its own PIP which could be changed, allowing valuable pension planning options.

In occupational schemes the PIP was generally set by the scheme trustees.

For individual schemes in place before 6 April 2011, the PIP was generally established by the starting date of the contributions to each pension plan and ended on:

- A nominated date during the tax year following the tax year in which the previous PIP ended; or

- The anniversary date of the first contribution (or last PIP).

However, from 6 April 2011 the government started the process of aligning PIP’s with the tax year (although the PIP could still be changed to allow valuable pension planning options). Post April 2011, the first PIP for a new individual arrangement started when the 1st contribution was paid and ended on the later of:

- a nominated date within a year of the start date, or

- if there’s no nominated date, the 5 April immediately following the start date (so unless nominated otherwise, if the start date was 1 April 2012, the first PIP ended a few days later on the 5 April 2012, and thereafter would have matched the tax years, unless another date was nominated).

PIP transitional arrangements for the 2015/16 tax year (Post Summer Budget 2015)

On 8 July 2015 the government completed the process of aligning all future Pension Input Periods with the tax year which came into force with immediate effect. The alignment of PIP's was required to support the Chancellor's introduction (with effect from April 2016) of the Tapered Annual Allowance for individuals. To ensure this measure works as intended, it was necessary to align pension input periods with the tax year. During the Summer Budget, HMRC announced that all Pension Input Periods open on 8 July 2015, ended on 8 July 2015 and the next Pension Input Period would be 9 July 2015 to 5 April 2016.

To ensure no one was penalised as a result of this immediate closing of all PIP’s transitional arrangements were introduced.

So the 2015-16 tax year is effectively split into two mini tax years for the purpose of annual allowance, the “pre-alignment tax year” and the “post-alignment tax year”.

Pre-alignment tax year

The transitional provisions mean individuals have an £80,000 annual allowance (plus any carry forward from 12/13, 13/14, 14/15) for all their pension savings in all pension input periods ending on or after 6 April 2015 and on or before 8 July 2015, hereafter referred to as the "pre-alignment tax year". In other words, clients have an £80,000 Annual Allowance for the part of their PIP which the Chancellor brought to a close on 8 July 2015. This measure was put in place so that any individual that had already used the ability to nominate a PIP end date to use their 2016-17 AA by a contribution paid in the 2015-16 tax year would not be retrospectively penalised.

Post-alignment tax year

Pension savings from 9 July 2015 to 5 April 2016 will have a nil annual allowance, but any of the unused £80,000 Annual Allowance from the pre-alignment period can be used, up to a maximum of £40,000 (plus carry-forward if applicable). This assumes they were a member of a registered pension scheme during the period 6 April 2015 and 8 July 2015 and had not triggered the MPAA. Those who were not a member of a registered pension scheme during the period 6 April 2015 to 8 July 2015 but joined a pension scheme between 9 July 2015 to 5 April 2016 will have an annual allowance of £40,000 for this period.

For DB or Cash Balance Pension Input Periods using the transitional provision for aligning pension input periods for the 2015-16 tax year

Special rules apply for calculating the pension input amounts for the mini tax years in 2015-16.

The pension input amount for the pre and post-alignment tax years will be a proportion of the pension input amount calculated as if both the pre and post alignment contributions had been made in a single pension input period, this is called the combined period. Please see below for details of how to calculate the pension input amount for the combined period.

The pension input amount for the post-alignment tax year will therefore be the proportion of the pension input amount for the combined period that related to the 272 days from 9 July 2015 to 5 April 2016.

Post-alignment pension input amount = the pension input amount for the combined period x 272/D.

Where D is the number of days in the combined period (which will vary from scheme to scheme dependant on the schemes PIP start date before the announcement on 8 July 2015 to align PIPs to the tax year).

The pension input amount for the pre-alignment tax year will be the pension input amount for the combined period less the proportioned post alignment pension input amount (as calculated above).

Calculating the pension input amount for the combined period

As the combined period will be at least 12 months and possibly longer, there have been two changes made to the normal pension input amount calculation to ensure fairness.

In a DB pension input calculation the CPI increase for the previous September (1.2% as at September 2014) would normally be used. However for the combined period this has been set at 2.5% to ensure that nobody is penalised by the extended combined period.

Similarly, for the purpose of calculating the relevant percentage used to work out if a deferred member benefit needs to be included in the AA calculation, the 2.5% rate rather than the standard CPI figure should be used. Further details on the special rules that apply to individuals who become deferred members during the combined period are available in HMRC’s Pensions technical note: Transitional provisions for aligning pension input periods. Details of how deferred member benefits are treated in a non-transitional year is detailed in the “Exemption from Annual Allowance test” section covered in our Annual Allowance for pension savings.

Pre and post alignment carry forward example

The following example is for an annual allowance test in respect of tax year 2018/19. Please refer to the notes below the table.

For 2018/19 and the previous six years Robert has been paying £2,000 gross on the 1st of each month to his money purchase scheme which, up until 8 July 2015, had a pension input period running 2 May - 1 May each year. Robert also makes a £16,000 gross contribution in September each year.

Pre alignment 2015-16 |

Post alignment 2015-16 |

2016-17 |

2017-18 |

2018-19 |

|

|---|---|---|---|---|---|

| Annual Allowance | £80,000 | Nil* | £40,000 | £40,000 | £40,000 |

| Pension Inputs | £44,000 | £34,000 | £40,000 | £40,000 | £40,000 |

| Unused Annual Allowance | £36,000* | £2,000 | NIL | NIL | NIL |

Notes*

Pre-alignment period: this covers contributions from 2 May 2014 to 1 May 2015, plus the contributions on 1 June and 1 July 2015.

Post-alignment period: this covers all contributions from 9 July 2015 - 5 April 2016.

In the above example Robert is expected to use his full Annual Allowance for the 2018/19 tax year, but will still have £2,000 unused pre-alignment Annual Allowance from the 2015/16 tax year. Although the post-alignment tax year has a Nil Annual Allowance it is possible to carry forward the unused pre-alignment AA (subject to a maximum of £40,000). Therefore in the above example Robert has the maximum amount of £36,000 unused pre-alignment Annual Allowance available, £34,000 of which is used by the post-alignment pension inputs, with the remaining £2,000 available for use in 2018/19. If this was not used before 6 April 2019 it is lost (as it now falls outside the three tax years allowed).

An additional point to understand is that unused Annual Allowance is only used up by Annual Allowance excesses in a tax year between the year the unused allowance arises and the current tax year.

Claiming carry forward

There is no requirement to claim carry forward or make an election to use carry forward. However, it is prudent to keep a record of when carry forward is being used in case HMRC require evidence to support tax returns.

We have a calculator which has a printable report option to help with this requirement. We also provide help for How to use our calculator.

The only requirement is to disclose any annual allowance charge where contributions are in excess of the total available allowance (including any carry forward). This must be reported through a self-assessment tax return.

The client must report the full annual allowance charge amount through self-assessment even where they require their scheme to pay some or all of the charge on their behalf. You can read more about dealing with the charge in our annual allowance article.

Tech Matters

Ask an expert

Submit your details and your question and one of your Account Managers will be in touch.