IHT & Estate Planning

Gifting and inheritance tax

Last Updated: 6 Apr 25 12 min read

Learn about Potentially Exempt Transfers (PETs) and Chargeable Lifetime Transfers (CLTs), their interaction with each other and the impact these gifts have on Inheritance Tax (IHT).

Discover why making gifts in a specific order is important and what the ‘14 year rule’ actually means.

Two main considerations when planning the IHT position of gifts are:

- the tax position whilst the individual is alive

- the tax position after the individual has died

Other considerations include:

- the value of the gifts – gifts above a certain amount may impact the availability of the nil rate band on subsequent gifts or could cause an IHT liability.

- the type of gift – the value that can be transferred as a PET is unlimited and PETs will drop out of the estate provided the donor survives for 7 years. CLTs may be chargeable immediately if the accumulated CLTs are more than the nil rate band. CLTs as well as PETs will complicate matters and their interaction with one another should be examined.

- succession of gifts and the order in which they are made – consideration should be given to the interaction of the types of gift and if previous gifts cause an impact on the current gift.

- the position if the settlor/donor dies within 7 years of making the gift /s– although PETs are unlimited, they will become chargeable to IHT if the individual making the gift dies within 7 years of doing so. Likewise, CLTs are also brought into the IHT calculation on death within 7 years. CLTs in excess of the nil rate band, where an entry charge was paid, will need recalculated at the death rate of 40% and any excess tax paid. CLTs made in the 7 years before a “failed PET” will also have an impact on the IHT calculation of the PET.

What are PETs and CLTs

Potentially Exempt Transfer (PET)

This is a gift or transfer of unlimited value which has the potential to be exempt. Outright gifts such as cash sums or transfers into absolute/bare trusts are PETs.

The rules state that the individual has to survive for 7 years after making the gift for it to be exempt. So, if the individual survives for 7 years, the PET escapes IHT altogether. PETs out with the 7 year period will never be brought into the IHT calculation.

A PET is only Potentially Exempt, so if the individual dies within 7 years of having made the gift, it “fails” and becomes a Chargeable Transfer (sometimes known as “failed PET”) for IHT purposes. This means that it will be taken into account in the individual’s IHT calculation.

Example 1a – 2 PETs in close succession and survival for 7 years

Amy gifts £500,000 to Alicia

The following year, Amy gifts £500,000 to Michael

IHT Position

- Total gifts equal £1,000,000

- The gifts are PETs, so unlimited amounts can be given and provided Amy lives for 7 years there will be no IHT consequences

- The gifts were made a year apart, each gift will have its own 7 year period, starting on the date the gift was made.

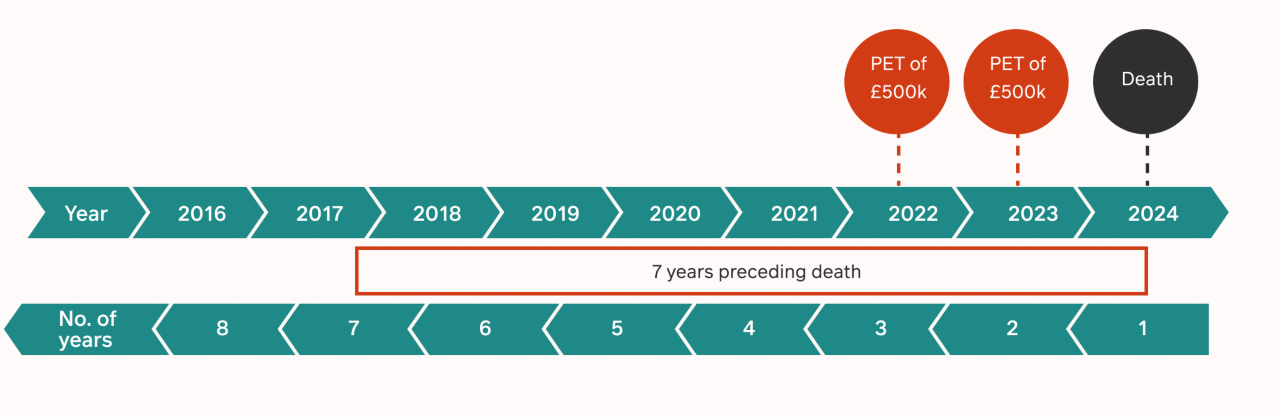

Example 1b – PETs and death within 7 years

Amy gifts £500,000 to Alicia

The following year, Amy gifts £500,000 to Michael.

Amy dies a year after making the gift to Michael

IHT Position

- The timeline above shows that both PETs are in the 7 years preceding death, therefore both PETs will “fail” and become chargeable in chronological order.

- The first failed PET will use all of the £325,000 nil rate band leaving £175,000 of this PET plus the full £500,000 of the second PET chargeable to IHT at 40%.

Example 2a – 2 PETs and survival for 7 years

Amy gifts £500,000 to Alicia

7 years later, Amy gifts £500,000 to Michael

IHT Position

- Total gifts equal £1,000,000

- The gifts are PETs, so unlimited amounts can be given and provided Amy lives for 7 years there will be no IHT consequences

- The gifts were made 7 years apart and each gift will have its own 7 year period.

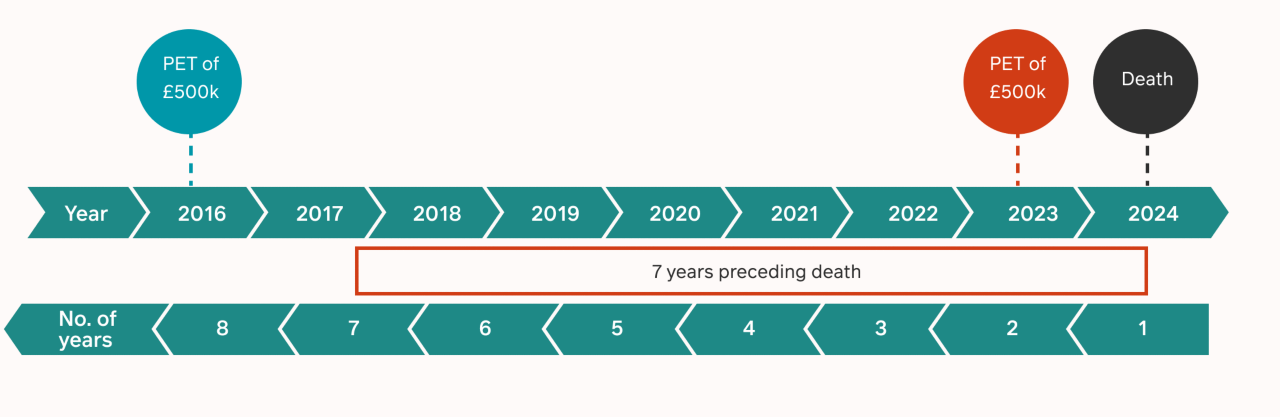

Example 2b – PETs and death within 7 years

8 years before she dies, Amy gifts £500,000 to Alicia

7 years later, Amy gifts £500,000 to Michael.

The following year, Amy dies

IHT Position

The timeline above shows that the first PET has dropped out as Amy has survived for 7 years after making it.

Only the second PET is within the 7 years preceding death, therefore only this PET will “fail” and become chargeable. This will use all of the £325,000 nil rate band leaving £175,000 of this PET chargeable to IHT at 40%.

Chargeable Lifetime Transfer (CLT)

Gifts such as transfers into discretionary trusts are Chargeable Lifetime Transfers (CLT).

A CLT is a gift made during an individual’s lifetime which is immediately chargeable to IHT. This does not necessarily mean that there will be IHT to pay but it does have to be assessed to see if a charge to IHT will arise. If the amount gifted is within the available nil rate band, then there will be no IHT due immediately.

CLTs are cumulative and CLTs made in the previous 7 years prior to the current CLT will reduce the amount of nil rate band available.

- If the sum of CLTs in the 7 year period is below the nil rate band, there will be no IHT due immediately.

- If the sum of CLTs in the 7 year period exceeds the nil rate band, then there will be a charge to IHT on the excess. The charge is at the lifetime rate of 20% (half of the death rate).

Either the trustees or the transferor can pay any IHT due. Where the tax is paid by the transferor, that is also a loss to the estate and is a transfer of value. A ‘net’ transfer therefore has to be grossed up to arrive at the chargeable transfer amount.

Consider a CLT of £8,000 when there is no available NRB and the transferor pays the tax. The value for IHT purposes will be £8,000 x 100/80 = £10,000 with IHT due of £2,000.

If an individual dies within 7 years of making a CLT, it will be brought into the IHT calculation and tax will be recalculated at the full rate.

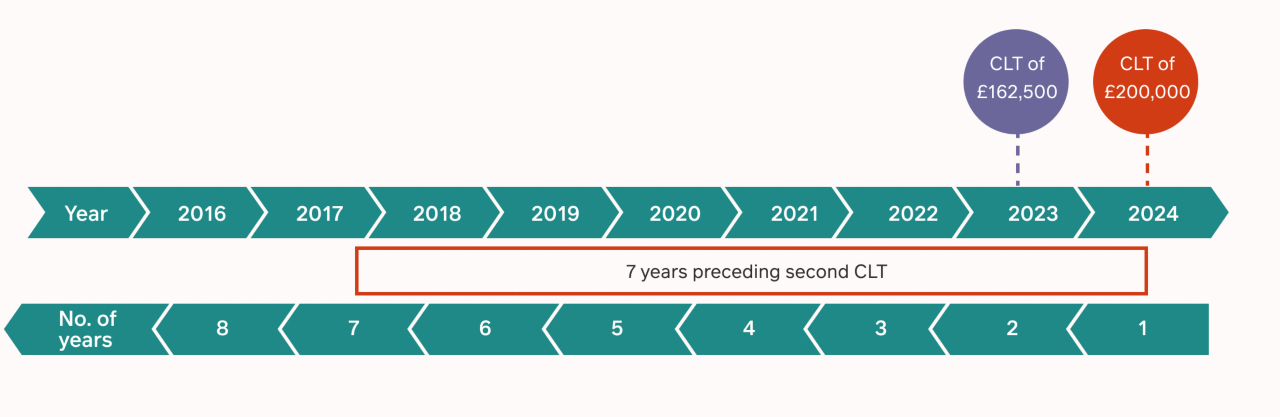

Example 3a – Two CLTs in a 7 year period

Amy gifts £162,500 to a discretionary trust

The following year, Amy gifts £200,000 to another discretionary trust.

IHT Position

- Total gifts equal £362,500

- The gifts are CLTs, so if the accumulation of CLTs in the 7 years exceeds the nil rate band, there will be an entry charge of 20% (half the death rate)

- The gifts were made a year apart.

- When each trust is created, it needs to be assessed to see if an entry charge applies.

- For Amy’s first trust , any entry charge would be determined by checking for CLTs in the preceding 7 years. The timeline shows that there are none.

- This means that there is no entry charge and that there is a full nil rate band available to the trust at the 10 year point.

- For Amy’s second trust , again check for CLTs in the preceding 7 years. The timeline shows that there was a CLT in the previous year and this used £162,500 of the nil rate band

- This means that only £162,500 of the nil rate band is available to the second trust (full nil rate band of £325,000 less previous CLT of £162,500 = £162,500). As this CLT is £200,000, the surplus over the £162,500 (£37,500) will be subject to an entry charge of 20%. If Amy pays the tax due, then a ‘grossing up’ exercise is required in recognition of the fact that her estate is also diminishing by the tax paid. This would be as follows £37,500/0.8 = £46,875 x 20% = tax due of £9,375.

- This trust will also be subject to charges at the 10 year point and an exit charge when monies are distributed to beneficiaries. The nil rate band at the point the charge applies will be reduced by £162,500 to determine the nil rate band available to the trust. For example, at the 10 year point, if the nil rate band is £450,000, then the nil rate band available to the trust will be £450,000 - £162,500 = £287,500

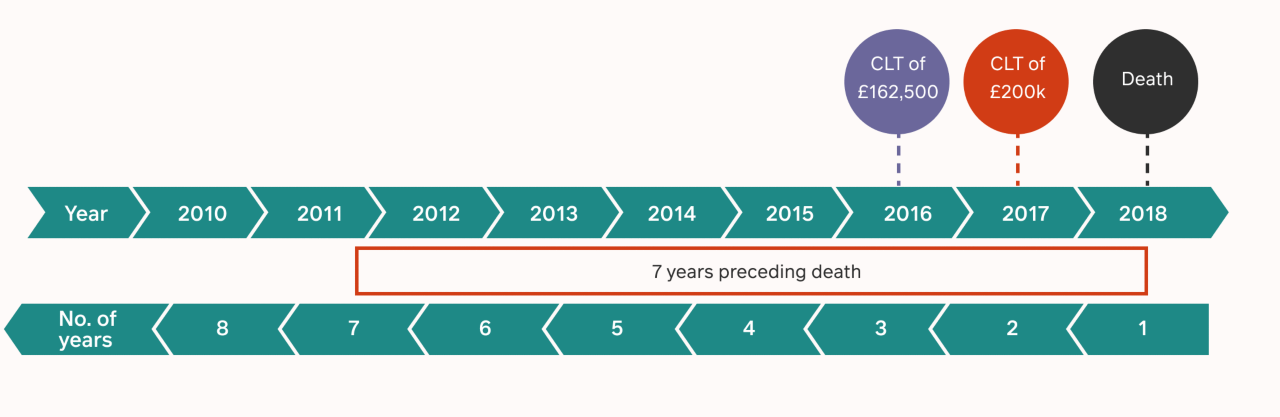

Example 3b - CLTs and death within 7 years

Amy gifts £162,500 to a discretionary trust

The following year, Amy gifts £200,000 to another discretionary trust

Amy dies a year after creating the second discretionary trust

- The timeline above shows that both CLTs are in the 7 years preceding death. The first CLT has already used £162,500 of the nil rate band. The second CLT has used the remaining £162,500 of the nil rate band and there was an entry charge on £37,500 of the £200,000 gift at the rate of 20% (half the death rate). See however ‘grossing up’ comments above.

- On death, the IHT due on the CLT is recalculated at the rate of 40% (full death rate). The tax will be calculated at 40% on the £37,500 over the nil rate band. The tax already paid at 20%, for the entry charge, can be deducted from this and only the difference will be payable.

It is important to note that the nil rate band at the time of death will apply and if the CLT was made more than 3 years prior to death, taper relief can be applied. If the IHT calculated on death is less than the tax already paid as an entry charge, there will be no refund of the tax paid.

How PETs & CLTs interact with each other

Order of trusts

If an individual is considering using a combination of different types of trust, the order in which the trusts are created should be taken into account.

If a loan trust is being used, this would normally be set up first. This is due to the fact that the settlor lends the money to set up the trust and as it is not a gift, it is neither a PET or a CLT. This will, therefore, have no impact on subsequent gifts.

For gifts made at the same time, usual planning would be to consider making CLTs before PETs. If done in this order, there is no risk of a “failed PET” reducing the nil rate band available throughout the lifetime of the trust created by the CLT.

PETs before CLTs

There are two issues to consider – entry charge on lifetime gifts into trust and impact of death.

Lifetime gifts

CLTs accumulated in the 7 years leading up to the start date of a lifetime discretionary trust are included to determine if an entry charge applies. PETs have no impact on this accumulation.

Impact of death

If, in a 7 year period, the individual makes a PET, then a CLT and subsequently dies, the PET will become a “chargeable transfer” (or “failed PET). Both the “failed PET” and the CLT will be included in the IHT calculation of the individual.

In addition, if a PET has been made in the 7 years leading up to the creation of the discretionary trust which resulted in a CLT, and subsequently “fails’, becoming chargeable, this causes an impact to the discretionary trust when assessing for periodic charges.

This is because chargeable transfers in the 7 years prior to the trust creation are added into the periodic charge computation.

CLTs before PETs

Again, there are two issues to consider – lifetime gifts and impact of death.

Lifetime gifts

During lifetime CLTs have no impact as PETs do not become chargeable unless the individual dies within 7 years of making them.

Impact of death

On estate

When calculating the IHT payable by the estate, “failed” (or chargeable) PETs and CLTs made in the 7 years before death are included.

On gifts

The 14 year rule applies where there are CLTs in the 7 years before a PET which has “failed”. This rule is there to ensure that gifts which become chargeable are taxed appropriately.

To work out if tax is payable on a gift, the law says that it must be added to any chargeable gifts made in the 7 years before the gift concerned.

- A ‘chargeable gift’ is a gift which is not fully exempt.

- A PET is potentially exempt and only becomes fully exempt if the individual who made it survives for 7 years.

Gifts are placed in the order they were made, starting with the oldest and moving towards the date of death. CLTs made in the 7 years before the “failed” PET will use nil rate band first, meaning that there could be more IHT due than anticipated on the “failed” PET.

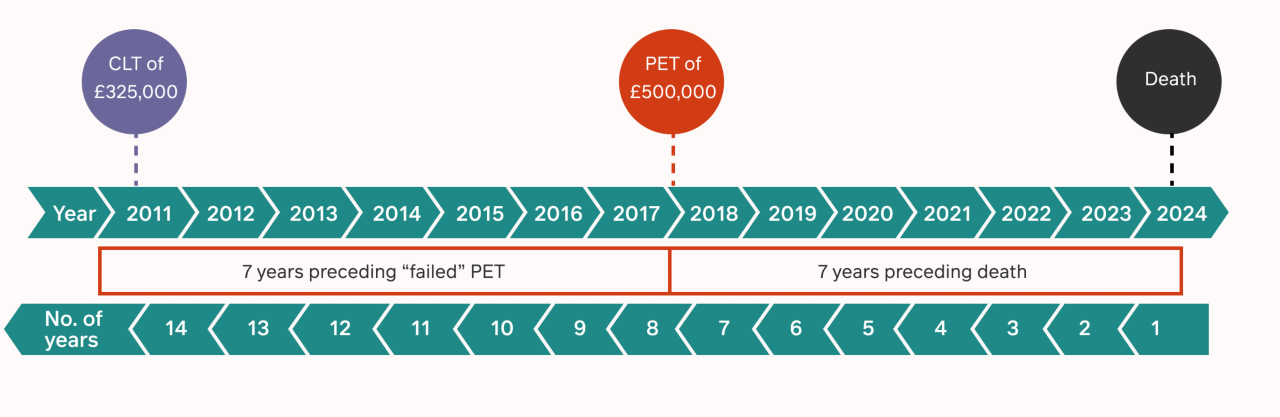

Example of the 14 year rule

Amy gifts £325,000 to a discretionary trust 12 years and 2 months ago

6½ years later, Amy gifts £500,000 to her son Peter

Lifetime gifts

Total gifts equal £825,000

The gifts are a mixture of PETs and CLTs, so the interaction between the two will need to be considered.

The first gift was a CLT of £325,000 (assume that the nil rate band was £325,000). There were no previous CLTs so, there was no entry charge.

The second gift was a PET of £500,000. Unlimited amounts can be given as PETs and provided Amy lives for 7 years there will be no IHT consequences. The previous CLT has no bearing on the PET whilst Amy is alive.

The gifts were made 6½ years apart.

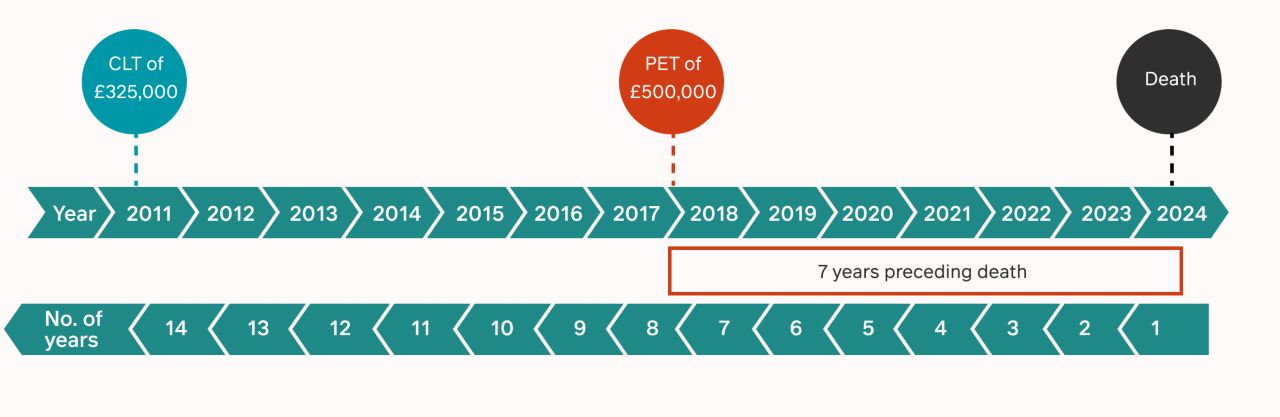

Impact of death

Amy gifts £325,000 to a discretionary trust 12 years and 2 months ago

6½ years later, Amy gifts £500,000 to her son Peter

Amy dies 5 years and 9 months later

On estate

- The timeline above shows the accumulation of gifts on the death estate calculation and you can see that the CLT is not added to the accumulation.

On gifts

- The timeline above shows that the PET is in the 7 years preceding death. This will “fail” and become chargeable.

- Remember the 14 year rule...as the CLT of £325,000 was 6½ years prior to the “failed PET”, even though it was more than 7 years prior to death, it will be brought into the calculation because it was in the 7 years preceding the “failed PET”.

- The CLT will use £325,000 of the £325,000 nil rate band, leaving no nil rate band to attribute to the PET which means the full value of the PET (£500,000) will be chargeable to IHT at 40%. However, taper relief would reduce the amount of tax payable in this example as explained further in our taper relief article.

Tech Matters

Ask an expert

Submit your details and your question and one of your Account Managers will be in touch.