| Income Band* | Tax Rate | Tax Due |

|---|---|---|

£12,570 |

0% |

£0 |

£37,700 |

20% |

£7,540 |

£1,730 |

40% |

£692 |

Total |

£8,232 |

Pensions

Bypass trusts for pension death benefits

Last Updated: 6 Apr 25 10 min read

Discover what bypass trusts are, why they might be used and the tax implications of using them.

Contents

1. Key Points

4. Inheritance Tax treatment of bypass trusts

Key Points

- Bypass trusts are still an effective planning tool

- The desire for control when passing on death benefits will dictate whether a bypass trust is set up

- Death after 75 doesn’t mean that a bypass trust is no longer relevant.

- It is the government’s intention that from a tax perspective the new rules mean that the position would be broadly the same for the beneficiary of a bypass trust, as those receiving benefits directly from the pension.

Please note that the following is the current position for IHT. A consultation was launched on 30 October 2024 and was open for responses until 22 January 2025. The consultation was on how to bring more pension benefits into the IHT regime. As and when further details are known on the consultation responses and draft legislation, this page will be updated.

What is a bypass trust?

This type of trust was more commonly referred to as a "spousal bypass trust", although it should have just been called a “bypass trust” as the intended beneficiaries may not always have been a spouse. A bypass trust is a discretionary trust which is set up by the member to receive pension death benefits.

Most providers offer a draft bypass trust or a solicitor can draft one. It is usually established with £10. At the same time an expression of wish form is filled out which requests that any death benefits paid from the scheme / trustees are paid to that trust. The member appoints and instructs the trustees of the bypass trust on how they wish them to distribute any funds the trust may ultimately receive on death.

On the death of the member the scheme administrator must exercise their discretion but if an expression of wish form provides guidance to do so they will usually pay to the bypass trust (unless the trustees believe that the situation warrants a differing course of action). It’s important to remember that the expression of wish where a scheme has discretion over the death benefits is just that, and whilst the scheme will check the members wishes, ultimately they decide where the benefits go. The trustees of the bypass trust will usually then distribute the funds in line with the member’s instructions.

The trustees of the bypass trust could even issue the benefits in the form of a loan, which would be repayable from the estate of the recipient on their death, ensuring the availability of funds for future beneficiaries. The member could instruct the SBT trustee to pay sufficient funds to the member’s spouse during their lifetime (or earlier marriage) and thereafter to their children/grandchildren etc. This could be in the form of a regular income or ad hoc lump sums from the trust.

Before setting up a bypass trust it is important to check how the scheme distributes the death benefits. Some schemes may have no discretion on who they pay and may be obligated to pay to the member’s estate or a particular beneficiary. If this is the case they may not be able to accept any expression of wish in favour of a bypass trust.

If a member changes their mind then they can supersede the expression of wish form which pointed to the bypass trust by completing another expression of wish form. The bypass trust will still exist but no death benefits will ever be payable to it. The trustees can bring the trust to an end by distributing the trust property to one or more of the potential beneficiaries, although the trust fund may only be the initial gift to establish the trust (normally £10).

Why set up a bypass trust?

As mentioned in the Inheritance Tax and Pensions article, death benefits are usually not liable to inheritance tax on the death of a member. The main reason that bypass trusts were set up before April 2015 was to receive the payment of lump sum death benefits so that they did not become part of the inheritance tax assessable estate of the intended beneficiaries.

However, new legislation introduced by the Taxation of Pensions Act 2014 meant that, in the vast majority of cases, the benefits are able to pass down through generations free of inheritance tax if they remain in the pension wrapper. As such many have said that bypass trusts are no longer required. However, it's important to note that on the death of the dependant/nominee, the funds usually pass to the successor nominated by the dependant/nominee, and not the original member's line of succession.

For example, if the surviving spouse is the beneficiary and designates the death benefit to dependant drawdown, if they remarry, they may nominate their new spouse to receive the pension benefits on their death. On inheriting, the new spouse may choose to pass these funds on to their own children and ignore the original member’s bloodline.

A bypass trust provides a degree of control over the ultimate destination of the monies accrued in a pension (as the trustees of the member’s trust will control the destination of what was the pension fund money). This level of control is not offered by pensions freedoms, where the member’s dependant or nominee will then nominate a successor via their own expression of wish form.

However, it is important to note that although the member appoints and instructs the trustees of the bypass trust, the distribution will be at the discretion of those trustees and as such they may choose not to follow the member’s instructions. Careful selection of trustees is imperative.

There may be many reasons why the member wants more control. As mentioned above, if the family situation is more complex then it could be to make sure that the pension money stays within the bloodline. It could also be due to the fact that the member doesn’t think that a beneficiary should be given the option of taking a cash lump sum and they would prefer a regular payment is made to the intended beneficiaries at the discretion of their chosen trustees. Or they might be considered that if a spouse received dependant’s drawdown and then ended up in long term care then the drawdown would be considered by the local authority, whereas if the funds were held in trust they would be disregarded in the financial assessment for long-term care.

It could also be because the member wants an adult child to benefit but are concerned the marriage is rocky and that if a divorce happened then any lump sum or drawdown could be considered matrimonial property.

Inheritance Tax treatment of bypass trusts

Pension schemes as settled property

Section 43(2) of the 1984 Inheritance Act means that amongst other things pension and annuity arrangements are settlements for IHT purposes.

As settled property, this would ordinarily result in the normal IHT charges at the point of settlement, each 10 years and on exit. However, there are specific exemptions within the act so that these IHT charges do not apply to pension or annuity arrangements.

On the member's death the scheme / trustees have two years from the date they were reasonably aware of the member's death on which to pay out any death benefits. After this period the exemptions enjoyed by pension arrangements cease to apply and periodic and exit charges may apply.

When using a bypass trust, the trust is subject to the normal discretionary trust taxation regime and periodic and exit charges may apply. However, the ten-year periodic charge anniversary applies from the date of the settlements. The determining factor is whether or not the trust-based / contract-based scheme has discretionary disposal powers. Typically the relevant date would be the date the member first joined the pension scheme for a trust-based scheme and for a contract-based scheme (e.g. retirement annuity contract / S226 plan), it would be the date of payment to the bypass trust or the date any benefits had been assigned to a trust.

The general principles are:

- where there are multiple schemes / contracts, for the purposes of IHT, there are multiple settlements each starting on the date the pension membership started for a trust-based scheme or where a contract-based scheme was placed under trust

- where there are no contributions to a scheme that scheme would not be counted as a settlement unless it accepted a transfer from a contract-based scheme

- where there is a transfer from a contract-based scheme into a trust-based scheme that also accepts contributions there would only be one settlement

- the bypass trust would count as a settlement as well

- each individual settlement would have its own nil rate band

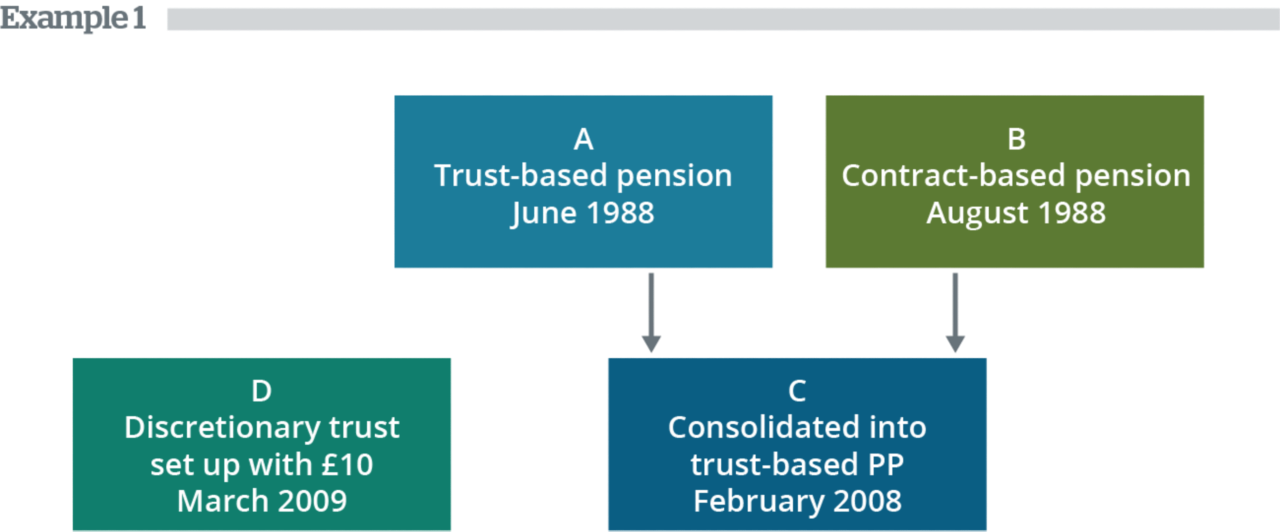

The examples below show the theory:

There are three settlements, A C and D:

A – 10-year anniversaries on June 1998, 2008, 2018, etc.

B – as this is contract-based there is yet to be a settlement

C – 10-year anniversaries on February 2008, 2018, 2028 (generated by the transfer in from B), etc.

D – 10-year anniversaries on March 2009, 2019, 2029, etc.

The charges would start to apply on the anniversaries after death where the money has been paid into the discretionary trust.

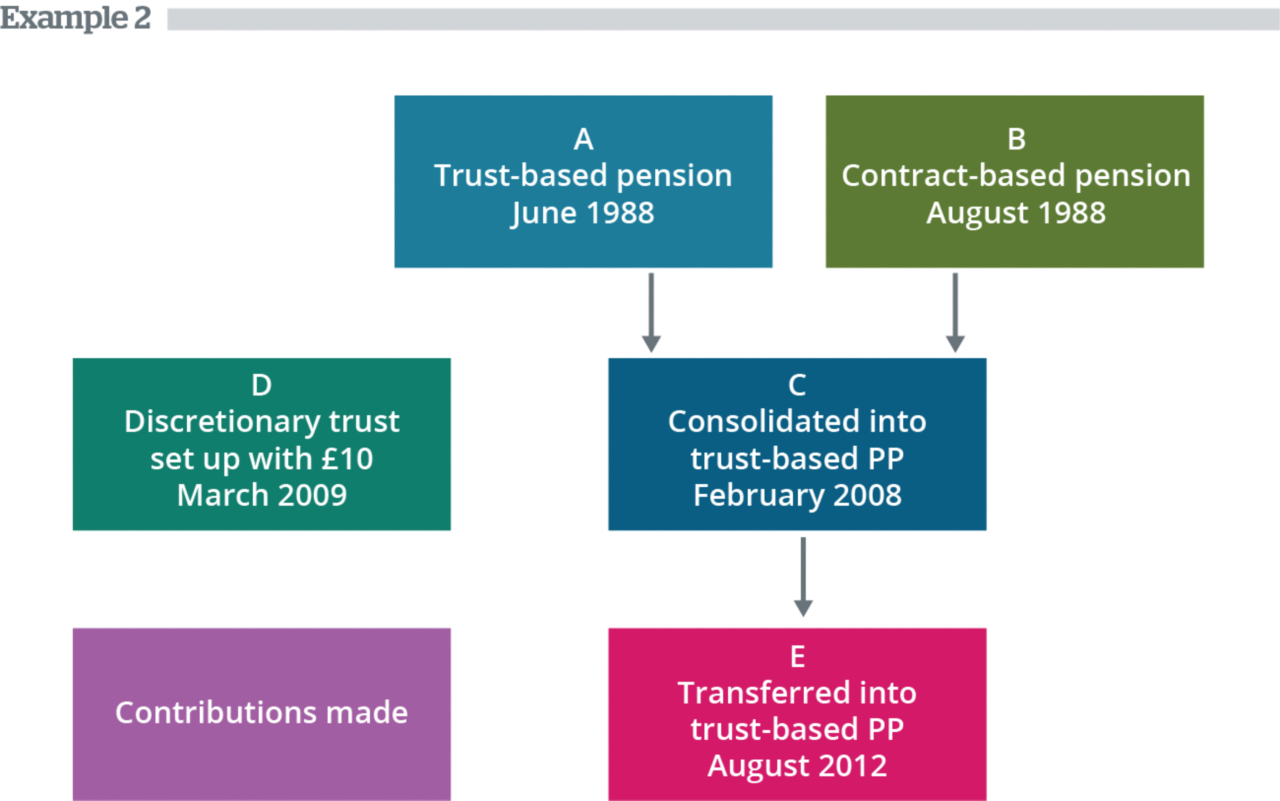

Taking the above scenario if there was a subsequent transfer into a trust based scheme 'E' in August 2012 and contributions were made to this scheme:

There are now four settlements, A C, D and E:

A – 10-year anniversaries on June 1998, 2008, 2018, etc.

B – as this is contract-based there is yet to be a settlement

C – 10-year anniversaries on February 2008, 2018, 2028 (generated by the transfer in from B), etc.

D – 10-year anniversaries on March 2009, 2019, 2029, etc.

E – 10-year anniversaries on August 2022, 2032, 2042, etc.

This is a complex area of trust and IHT law and expert advice should be sought if in doubt.

Income tax treatment of bypass trusts

Death before age 75 and within two-year relevant period

Scheme administrators will make any lump sum payment to the trustees of the bypass trust without deduction of any tax. Any amounts within the members available lump sum and death benefit allowance (LSDBA) are tax free. Any amount of lump sum in excess of the LSDBA are taxed as pensions income. HMRC stated the following in their February 2024 LTA newsletter:

Question 1 — what is the tax treatment of lump sum death benefits, paid in excess of the deceased member’s available allowance, where the payment is to non-qualifying persons?

If the lump sum is paid within the relevant two-year period, then the excess over the deceased member’s available lump sum and death benefit allowance is taxed as pension income. For non-qualifying persons who are not subject to the higher or additional rates of income tax, this will be basic rate tax (or the trust rate if applicable).

If the lump sum is not paid before the end of the relevant two-year period, then the whole of the lump sum is subject to the special lump sum death benefit charge.

This two-year rule does not apply to pension protection lump sum death benefits or annuity protection lump sum death benefits, consistent with their treatment before 6 April 2024.

We have contacted HMRC for further clarification on how the trustees will manage the tax pool in respect of such payments and will update this article in due course.

Death after age 75 or under 75 and out with the relevant two-year period

Lump sums will be subject to the 45% special lump sum death benefit tax charge.

However, legislation introduced on 6 April 2016 means this 45% may not be totally lost to the ultimate beneficiaries of the trust.

Section 206 (7) provides that a Lump Sum Death Benefit (LSDB) is not to be treated as income for any purposes of the Taxes Acts.

(a) it’s not income

(b) it’s not to be treated as income

So therefore it would seem that this money is lost to tax.

However, subsection (8) states that:

Where a LSDB is paid to a non-qualifying person* as trustee

and

that LSDB is distributed to an “individual” beneficiary

then

the amount received by the beneficiary (which will have suffered a 45% tax charge) and the tax charge is income of the beneficiary for tax purposes.

The 45% is therefore off-settable and the individual beneficiary may claim relief for the 45% tax.

*A non–qualifying person is defined as:

A person who is not an individual (a trust meets this definition)

Or

An individual who is acting in the capacity of a trust

(... and some others)

So (in the context of a SBT) a payment of LSDB to the trust then to a beneficiary is treated as income of that beneficiary, net of a reclaimable 45% tax credit.

Finance Act 2004, section 206 (7-10)

The administration process involved

Pension Schemes Newsletter 77 detailed that the pension scheme will have to inform the trustees of the gross value of the lump sum death benefit and the tax that has been deducted. The scheme administrators have to provide this within 30 days of making the payment to the trustees.

Further to this when the trustees then make a payment to a beneficiary from all (or part) of the lump sum death benefit received, they have to inform the beneficiary what proportionate gross value of the lump sum and tax paid from the pension scheme has been made to them. They must also provide this to the beneficiary within 30 days.

To reclaim any tax that may be due, the beneficiary will have to put this in their self-assessment tax return, which may lead to a refund in tax. If the individual doesn’t normally complete a tax return they can claim a refund using form R40.

Example of the taxation of a bypass trust

A member has died post 75 and a lump sum death benefit payment of £45,000 is made to an individual with £52,000 adjusted net income.

Before any lump sum death benefits are paid the tax position of the individual is as follows:

Ignoring the initial emergency tax that will be paid the income will be taxed as below:

| Income Band* | Tax Rate | Tax Due |

|---|---|---|

£12,570 |

0% |

£0 |

£37,700 |

20% |

£7,540 |

£1,730 |

40% |

£692 |

£45,000 |

40% |

£18,000 |

Total |

£26,232 |

*Scottish taxpayers will pay the Scottish rate of income tax (SRIT) on non-savings and non-dividend (NSND) income. NSND income includes employment income, profits from self-employment (including sole trades and partnerships), rental profits, and pension income (including the state pension). Similarly, from 6 April 2019 Welsh Taxpayers pay the Welsh Rate of Income Tax (CRIT (C for Cymru)) on NSND income.

Other tax and deductions such as Corporation Tax, dividends, savings income and National Insurance Contributions etc. will remain based on UK rules. This could mean the amount of income tax relief which can be claimed on pension contributions by Scottish and UK tax payers may not be the same. For more info on SRIT and how this works in practice, please visit our facts page. For more info on CRIT and how this works in practice, please visit our facts page.

Therefore in this instance the recipient of the lump sum has had to pay £18,000 more in tax so the net benefit is £27,000.

If the lump sum were directed towards a trust the initial tax would be simple:

| Income Band | Tax Rate | Tax Due |

|---|---|---|

£45,000 |

45% |

£20,250 |

Total |

£20,250 |

As per the above the scheme would pay out £24,750 to the trust and the scheme administrators have 30 days to inform the trustees that there was a £45,000 gross value of the lump sum death benefit and that £20,250 tax had been paid.

If the trustees immediately paid £24,750 to a beneficiary, then this is paid with a tax credit of £20,250, so the total payment assessed against income tax is £45,000. At higher rate tax the liability on this would be deemed to be £18,000. As the tax credit is worth £20,250 there is actually an additional £2,250 that can be used to off-set tax paid by the individual. This effectively adds a further £2,250 to the net position of the £24,750. Which as per the money going to an individual gives the beneficiary a £27,000 net benefit.

When should a bypass trust be used?

Whichever route to cascade wealth through the generations is taken this should be thoroughly discussed with existing and new clients alike. Understanding the tax treatment of a lump sum paid to a bypass trust as well as the ongoing tax treatment of a discretionary trust (periodic charges, exit charges and taxation of investments held) will be essential. However, if a client’s main objective is to be able to influence the ultimate destination of the accumulated money over the wrapper that it’s held in, a bypass trust is the only way to achieve that level of control.

The client will need to carefully weigh up the tax benefits that might be achievable by keeping the death benefits within the pension environment (nominee and successor drawdown) vs the control a bypass trust offers over distribution to beneficiaries.

The cost of control might be more important to the client but there’s no one size fits all solution.

Tech Matters

Ask an expert

Submit your details and your question and one of your Account Managers will be in touch.