Market Outlook

Emerging Markets – Benefits for a diversified portfolio

Last Updated: 10 Feb 25 4 min read

Contents

1. What is an emerging market?

2. Why invest in emerging markets?

4. Emerging markets within PruFund

5. Outlook

What is an emerging market?

Countries that are experiencing fast growth as they transition from low-income and underdeveloped economies to higher-income industrial and services led countries.

Did you know, 85% of the world population lives in an emerging market country? The term ‘emerging markets’ was first introduced in 1981 by economist Antoine van Agtmael to reframe investor perceptions of previous labelled ‘third world’ countries.

Today, many countries categorised as emerging markets have already transitioned to becoming industry and service led. This makes terms such as ‘growth markets’ or ‘frontier markets’ better suited to reflect the innovation, adaptability and resilience of their economies.

Why invest in emerging markets?

One of the main benefits of investing in emerging markets is the expectation of higher investment returns compared to developed economies. This is due to their higher economic growth, driven by favourable demographics (younger, growing populations), improving governance (growing stability, transparency and effectiveness of organisations) and global competitiveness.

3 benefits of emerging markets

- Sources of income – representing 85% of the global population and the fastest growing labour force as advanced economies stall, emerging markets are not showing signs of slowing. Increased urbanisation of emerging markets is expected to drive productivity, while a growing middle-class population will continue to become a significant share of the consumer market. There is also a general link between demographic growth and economic growth and eventually the market capitalisation of companies – which benefits investors entering early into these markets.

- Growth opportunities – the rate of technological adaptation in emerging markets is among the highest in the world. Countries such as South Korea, China and Taiwan play key roles in the crucial semiconductor market from the simplest to the most complex chips. Sustainable powering of technology requires investment into renewable energy such as solar panels and electric vehicles for which China is a top exporter.

- Improving credentials – emerging markets account for half of global Gross Domestic Product (GDP) and 67% of global growth over the last 10 years, and are expected to continue to experience the highest growth rates globally. These economies are increasingly gaining influence through collaboration and the creation of trade blocs, uniting behind common goals despite differing views and experiences between them.

Alongside fast growth comes increased risks to investors due to factors such as regulatory quality, inflation and political stability.

Emerging markets in action

- China is the world’s largest exporting country and the second biggest economy in the world.

- India is the most populous country in the world, and a global leader in IT and business process outsourcing.

- Taiwan is home to the global semiconductor industry, critical for artificial intelligence (AI).

- South Africa has a sophisticated financial sector with strong connections throughout the African continent.

Emerging markets within PruFund

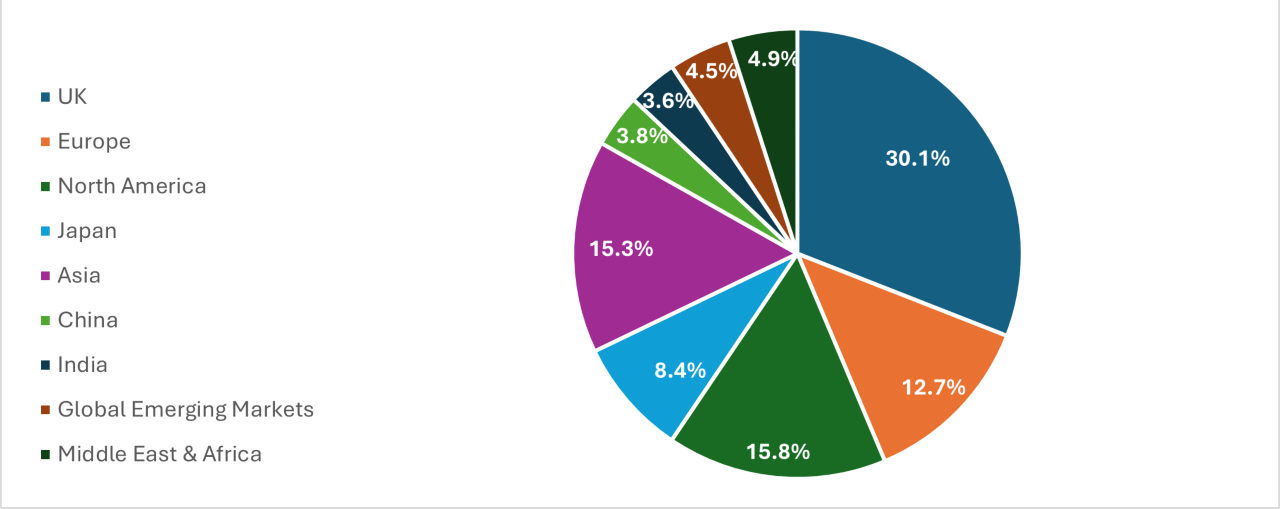

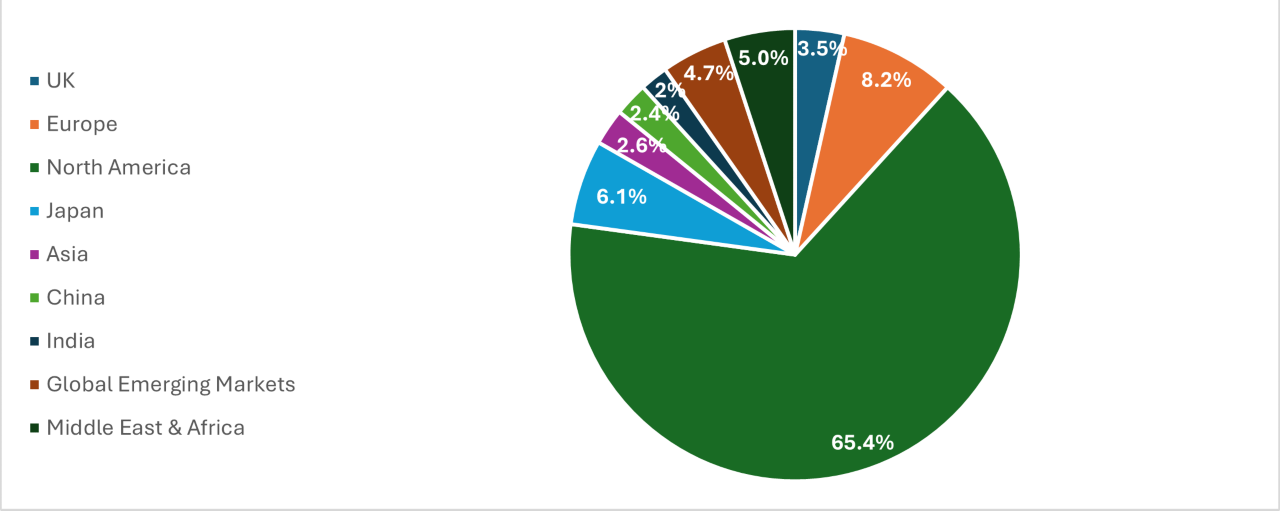

PruFund Growth is overweight on emerging markets compared to the global equities benchmark MSCI AC World, it is also more geographically diversified.

PruFund Growth Equity Allocation

Source: M&G Treasury & Investment Office – as at November 2024

MSCI AC World Equity Allocation

Source: M&G Treasury & Investment Office – as at September 2024

Outlook

We continue to see value in pursuing portfolios that are well diversified across different asset classes and regions, with positive exposure to emerging markets and the growth opportunities that they bring.

We are also mindful of the risks posed from the different regions and continually monitor closely what is happening in economies globally. As a team we always look to evolve portfolios and add or increase exposures that offer different return profiles, in order to provide the best possible outcomes for clients.

Please note that the value of an investment can go down as well up and your client may get back less than they have originally invested.