Market Outlook

Staying invested – the power of staying the course

Last Updated: 20 Mar 25 1 min read

Time is an investors greatest friend. Despite wars, economic recessions and pandemics, markets have demonstrated a remarkable ability to recover and grow over the long term. Regardless of the level of market sell-off some of the large unexpected events have often only had a temporary impact in the context of long-term trends.

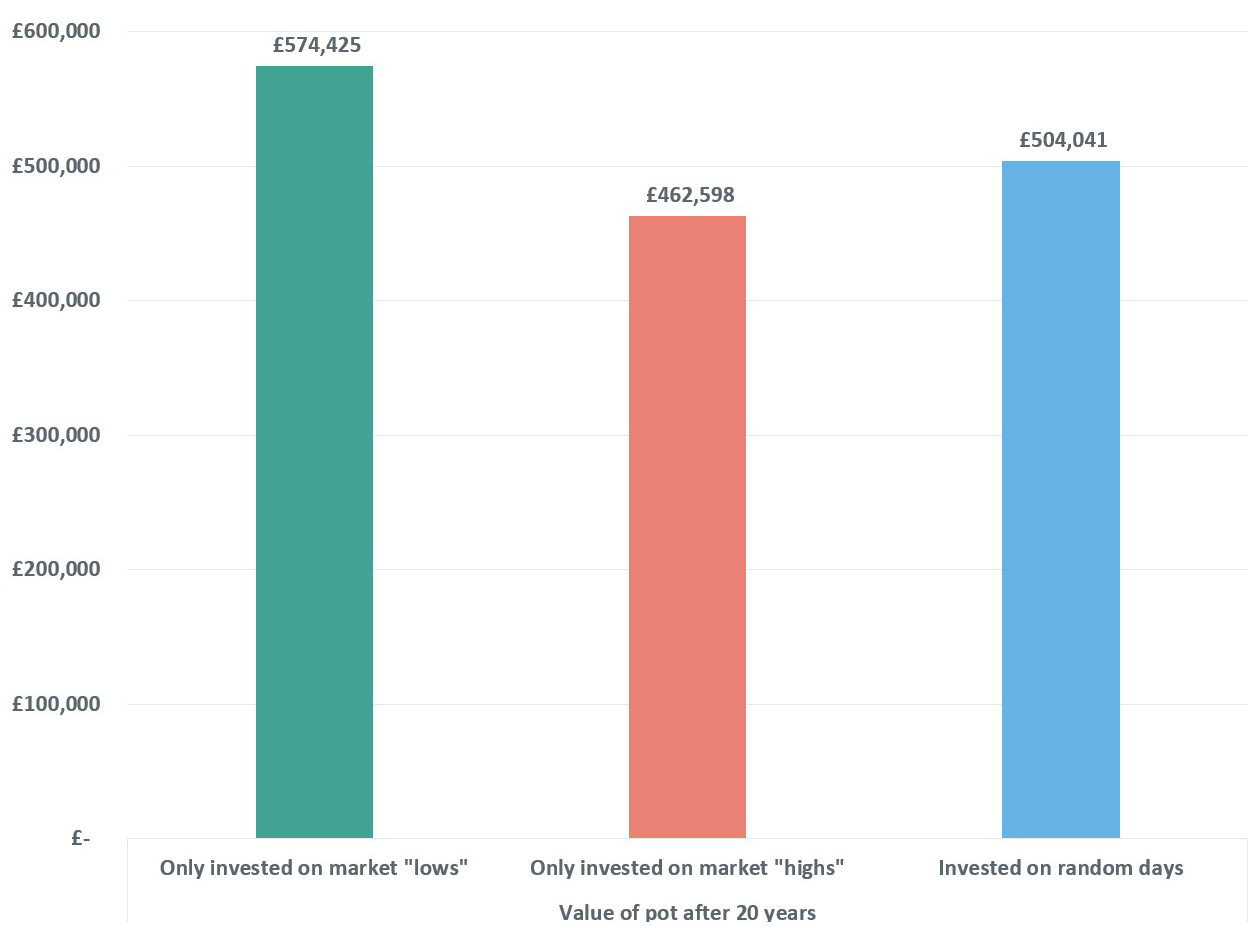

For example, assume a client invests £10,000 per year in an index fund that tracks the MSCI World over the last 20 years. The MSCI World Index is a commonly used benchmark for global stock funds – intended to represent a broad section of global markets.

Benefit of consistent long-term investing - £10k annual investment over 20 years

This highlights that even investing once a year on a randomly selected day, the investor’s portfolio would have been anywhere between £462-£574,000 compared to £200,000 if they had just kept it in cash. Or, as M&G's Director of Long Term Investment Strategy Parit Jakhria would say, “a long-term view and time in the market beats timing the market.“

The chart below highlights that.

Source: LSEG, as of end November 2024

Avoiding the silent erosion of wealth

Staying invested not only helps capture the rewards of economic recovery but also combats the silent erosion of wealth caused by inflation.

Inflation is unlikely to repeat the low and stable trajectory of the past few decades, as shifts such as climate change and changes in demographics can apply upward pressure on inflation. Geopolitical tensions can also be inflationary through costs incurred from increased defence spending and nearshoring (moving business operations to nearby countries).

Therefore it is important that client’s investments offer a degree of confidence to beat inflation even during uncertain times.

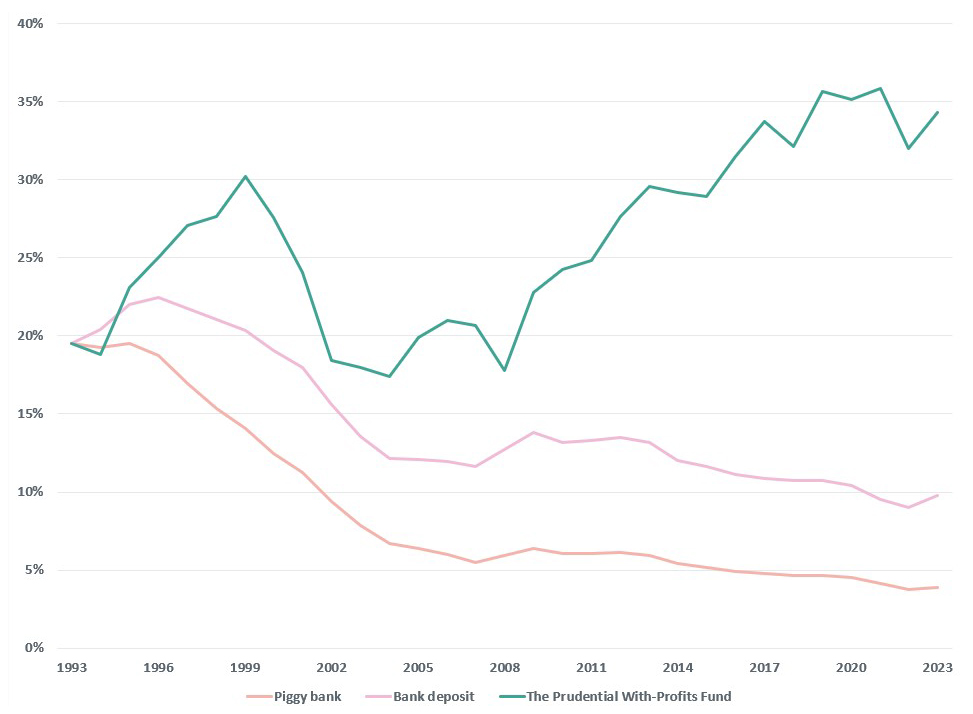

Let's consider an example for a parent hoping to help their children pay towards a house deposit in the UK in 30 years’ time. A £10,000 investment in a diversified multi-asset fund such as the Prudential With-Profits Fund would’ve given the investors increased financial power to afford a higher deposit for a house in the UK.

Keeping the money under the mattress or in a piggy bank would offer a worse outcome since the value of £10k 30 years ago would still be £10k today, but an average house price would have jumped from £52k to £259k over the 30 years!

The value of an investment can go down as well as up and your clients may get back less than they’ve paid in. Past performance is not a reliable indicator of future performance.

Purchasing power of a house deposit in the UK over the past 30 years

Source: LSEG, as of end November 2024

Outlook

While inflation has fallen from its peak, it remains at elevated levels and continues to influence market performance across the globe. This strengthens the importance of maintaining a well-diversified long-term investment approach rather than reacting to short-term market swings. If the growth from savings accounts cannot keep up with inflation, it will offer little real-life value. By staying committed to carefully considered plans, investors can navigate through periods of volatility, uncertainty and higher inflation.