News and Views

A golden time for pensions

Last Updated: 13 Jul 23 4 min read

Pensions are a simple and effective way to reduce tax liabilities. Recent fiscal statements have created a tax landscape where tax and tax payers is on the rise. I doubt you will find anyone who is not impacted. Some minor, but some major.

Fiscal drag is key. This is where rising incomes with frozen allowances and thresholds makes for more taxpayers paying more tax. On the plus side tax rates are unchanged (except in Scotland).

The OBR estimate 3.2 million more people paying income tax, and 2.6 million more higher rate taxpayers. At the top end, additional rate tax now kicks in at £125,140. This impacts an estimated 792,000, with 232,000 paying it for the first time.

The taxation of Capital Gains has remained as is but the allowance has more than halved and will half again next year. So more taxable gains – for an estimated 260,000 new CGT payers, albeit some of these will be trusts where a pension contribution to mitigate tax isn’t available.

Dividends have had a double whammy. A rate increase of 1.25%, and an allowance halved and to be halved again. Over three million people will be impacted by this measure, with many paying tax on dividends for the first time.

The two main “tax traps”, where child benefit and personal allowance are withdrawn from £50,000 and £100,000 respectively, remain untouched. So rising incomes will see more dragged into the trap.

Pension tax relief must be considered alongside the annual allowance which can negate any tax relief benefits received. There has been good news here as the three strains of Annual Allowance - standard, money purchase and tapered have all been increased allowing more to be saved into pensions without triggering an annual allowance charge.

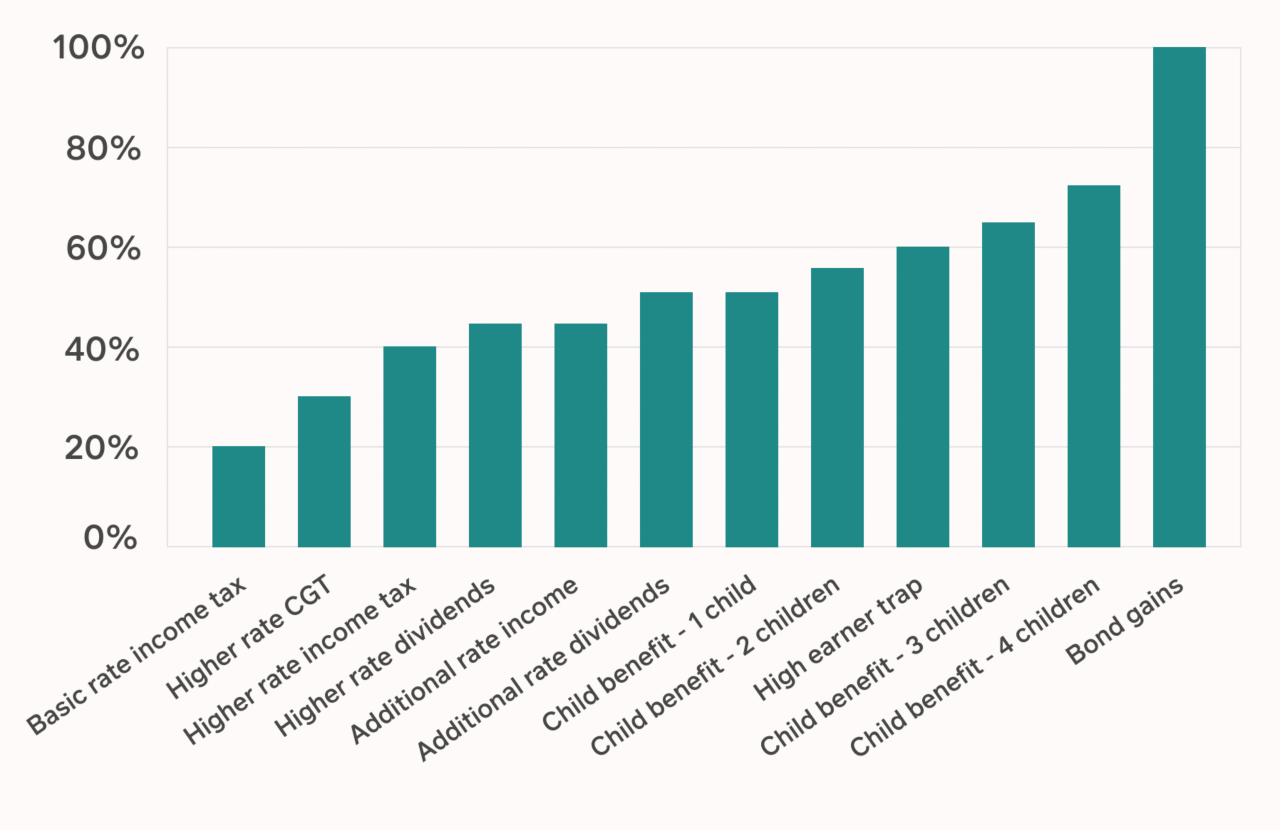

The rate of tax relief you receive is primarily driven by the amount and type of income you have that you can move into a lower tax band by paying into a pension. Exiting a tax trap described above can also boost the relief you get. Higher than marginal rate tax relief can be achieved for some. And! It can be in excess of 100% when you manage to boost the amount of top slicing relief where bond gains are in play.

There are a number of helpful tools on our platform, including a tax relief modeller, which is great for quickly and easily identifying someone’s tax liability and, importantly, demonstrating the tax benefits of making pension contributions.

The changing tax landscape with more people paying more tax, combined with a quick and simple way to calculate the tax relief benefits of pensions contributions, should mean we are in a golden age for pension tax planning.

Tech Matters

Ask an expert

Submit your details and your question and one of your Account Managers will be in touch.