If allowed in the pension scheme's rules, it’s possible to have a mixture of death benefits and for the death benefits to be provided to more than one beneficiary. Sections 167 and 168 and Schedules 28 and 29 Finance Act 2004 |

Pensions

Death benefits from defined contribution schemes

Last Updated: 6 Apr 25 21 min read

Learn about the different types of death benefits payable from defined contribution schemes, and the way they’re taxed.

Contents

1. Key Points

2. Background

3. What can a defined contribution scheme legislatively offer and to whom

4. Definitions

8. The Lump Sum and Death Benefits Allowance (LSDBA)

9. Paying the LSDBA excess tax charge

10. Charity lump sum death benefit

Key Points

- Defined contribution schemes usually offer lump sum and income death benefits.

- Each scheme will define the treatment of benefits on the death of a member and each scheme may be different.

- Death benefits from occupational defined contribution schemes may not offer full flexibility of death benefits.

- Death benefits are usually tax-free if the member dies when they are under 75, they are settled within two years of the scheme administrator becoming aware and the lump sum is within the member’s lump sum and death benefits allowance, or settled as beneficiaries income.

- Death benefits are taxable if the member / beneficiary dies after reaching age 75.

- Charity lump sum death benefits may be available.

Background

Legislation effective from 6 April 2015 resulted in a significant change in the options and definitions surrounding death benefits, and how they are taxed. This article focuses on the death benefits available from defined contribution schemes.

The death benefits payable are based on a number of factors. These include the type of scheme, who is to receive the benefit and how they are to be paid and if the death is before or after age 75.

What can a defined contribution scheme legislatively offer and to whom

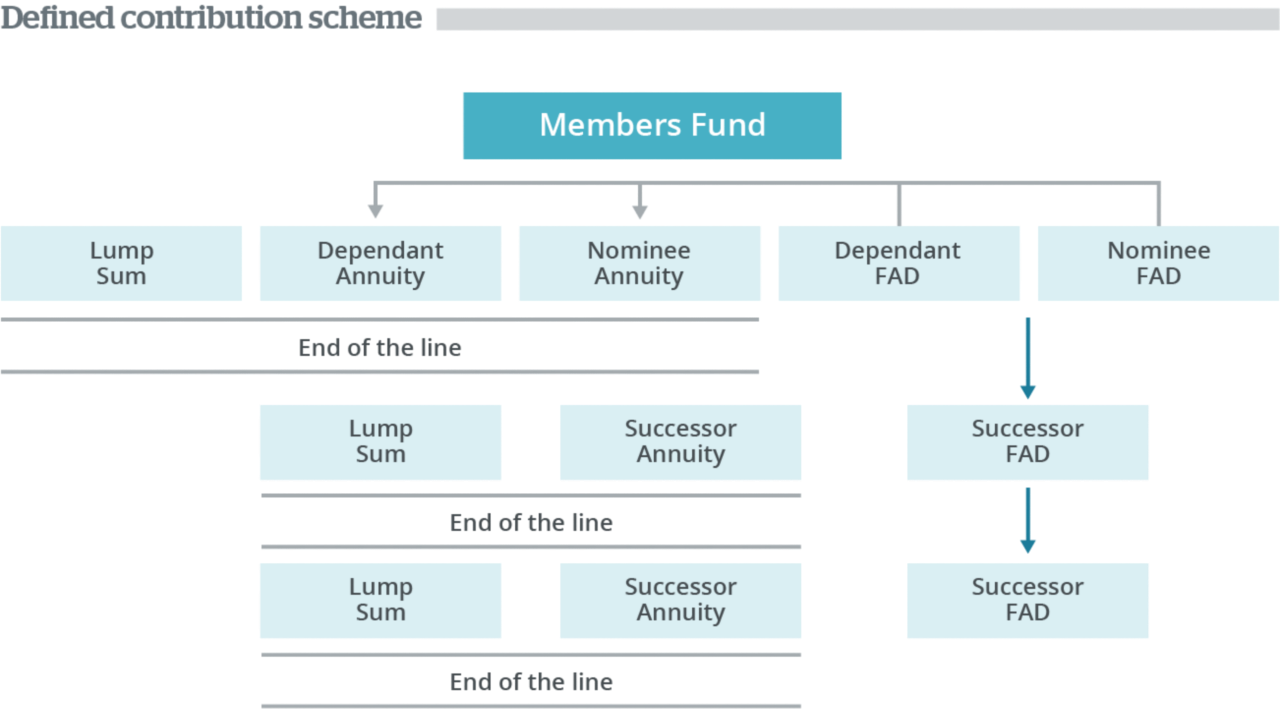

This diagram explains who can receive and what they can receive legislatively. However, this is when a defined contribution scheme offers the full range of flexibility.

The type of benefits that might be offered are:

- cash lump sums,

- dependants’ / nominees’ / successors’ annuity

- dependants’ / nominees’ / successors’ drawdown.

The recipient(s) of death benefits are usually chosen at the discretion of the pension scheme trustees or administrator. However, a member / pension holder can nominate whom they wish to receive the benefits by completing a nomination of beneficiaries form (sometimes, and more accurately, called an "expression of wish") and the trustees will usually take this into account.

It's important to note that when the funds pass to a beneficiary, following the death of a pension holder, the funds will follow the beneficiary’s choice of subsequent successor. So the original member has no control over the remaining funds and the choice for later payments after their beneficiaries subsequent death. The exception to this is where the original member nominated a charity which is explained later when we discuss charity lump sum death benefits.

As such, if the funds initially pass to say a spouse, the spouse can subsequently leave the money to say, the children of a later relationship (rather than the children of the pension holder). To retain a degree of control it's still possible to nominate for the death benefits to be paid to a trust. A commonly used trust to facilitate this control is a bypass trust. More information can be found in our bypass trusts facts article.

Before the different types of death benefit are considered, what do the definitions mean?

Definitions

What is a dependant?

The HMRC definition of a "dependant" is broadly:

- The member's widow(er) or civil partner at the time of the member's death

- A child of the member who is under the age 23

- A child of the member who, in the opinion of the scheme administrator, is dependant on the member, because of physical or mental impairment, at the date of the member's death.

- A person who wasn't married or in a civil partnership and is not child of the member, who in the opinion of the scheme administrator is, at the date of the member’s death:

- financially dependent on the member

- in a financial relationship of mutual dependency with the member

- dependent on the member due to mental or physical impairment.

- financially dependent on the member

Paragraph 15 Schedule 28 Finance Act 2004

Pension scheme rules may restrict to a narrower definition of dependant (for example, a younger cessation age for a child's pension). The scheme rules rule.

What is a nominee?

Nominee

This is any individual who is nominated to receive the death benefits, by either the member or by the scheme administrator. A nominee is someone who's not a dependant. If the scheme is going to pay benefits as an income, the scheme can choose a nominee only where the member has no dependants and the member didn't choose a nominee. If:

- the scheme doesn't have a nominee from the member, but

- there is someone who qualifies as a dependant and

- the scheme considers it inappropriate to pay to the dependant (such as in the case of an estranged spouse), the scheme can pay only a lump sum to a non-dependant, as a dependant exists.

What is a successor?

Successor

A 'successor' is an individual:

- nominated by a dependant of the member,

- nominated by a nominee of the member,

- nominated by a successor of the member, or

- nominated by the scheme administrator.

Types of death benefits

Lump sum death benefits

A lump sum may be paid on the death of the member. If the member is in drawdown then it would be a drawdown lump sum death benefit subject to the following conditions;

- it is paid in respect of either income withdrawal (drawdown) to which a member / dependant / nominee or successor was entitled to be paid at the date of their death,

- it is not a charity lump sum death benefit.

The maximum amount which can be paid is the total of all the assets in drawdown.

Paragraph 17 Schedule 29 Finance Act 2004

If a member has not crystallised funds yet, the lump sum will be an uncrystallised funds lump sum death benefit if it isn’t a charity lump sum death benefit.

Paragraph 15 Schedule 29 Finance Act 2004

Dependants’ or nominees’ annuity

From 6 April 2015 onwards, to be a dependants’ or nominees’ annuity, the annuity contract must either:

- be purchased from any uncrystallised funds or drawdown fund remaining on the death of the member. It may also be purchased from the drawdown fund of the dependant concerned, or from the flexi-access drawdown of the nominee concerned; or

- be a future dependants’ or nominees’ annuity provided for at the time the member purchased their own lifetime annuity (this is covered in detail in our article Death benefits and annuities)

Paragraphs 15(2A) and (2B), 17 and 27AA Schedule 28 Finance Act 2004

Successor's annuity

An annuity payable to a successor is a successor's annuity if:

- the successor becomes entitled to it on or after 6 April 2015,

- it is payable by an insurance company,

- it is payable until the successor's death or until the earliest of the successor's marrying, entering into a civil partnership or dying,

- it is purchased after the death of a dependant, nominee or successor of the member (the beneficiary),

- it is purchased using undrawn funds, and

- the beneficiary dies on or after 3 December 2014.

For the purposes of an arrangement after the beneficiary's death, the funds within the following are classed as undrawn funds if, immediately before the beneficiary's death, they were held within:

- dependant's flexi-access drawdown fund,

- dependant's drawdown pension fund (capped drawdown),

- nominee's flexi-access drawdown fund,

- successor's flexi-access drawdown fund,

A successors’ annuity is not the direct continuation of a joint or nominees’ annuity.

Section 167(1) Finance Act 2004 and Paragraph 27FA Schedule 28 Finance Act 2004

If any type of annuity is purchased then the money is leaving the pensions environment.

Dependants’ / nominees’ / successors’ drawdown

Flexi–access drawdown for a beneficiary works in a similar way to flexi-access drawdown for a member but without the age restrictions in relation to access. Therefore, a child aged 5 years old may be receiving drawdown income. The beneficiary can take anything between 0% or 100% of the drawdown fund.

If a beneficiary chooses to move into drawdown then the money remains within the pension environment. This means that on the death of the beneficiary, the funds can pass onto their beneficiary (successor) and so on.

Dependants’ drawdown was available before 6 April 2015 but it was not possible for anyone apart from a dependant to benefit. If a dependant was in capped drawdown on 5 April 2015 then they can remain in capped drawdown but all the rules of capped drawdown will still apply. They can also choose to convert to flexi-access drawdown.

Note that this action does not invoke any Money Purchase Annual Allowance rules.

Paragraphs 22B to 22D Schedule 28 Finance Act 2004

If a dependant was in flexible drawdown immediately before 6 April 2015 then from that date it is automatically treated as a flexi-access drawdown fund.

If a dependant child first designated funds into drawdown (flexi-access or capped) before age 23 and then reached age 23 after the 16 September 2016, they can continue to receive dependant’s drawdown, regardless of the fact that they have passed age 23.

Paragraph 6 Schedule 5 Finance Act 2016

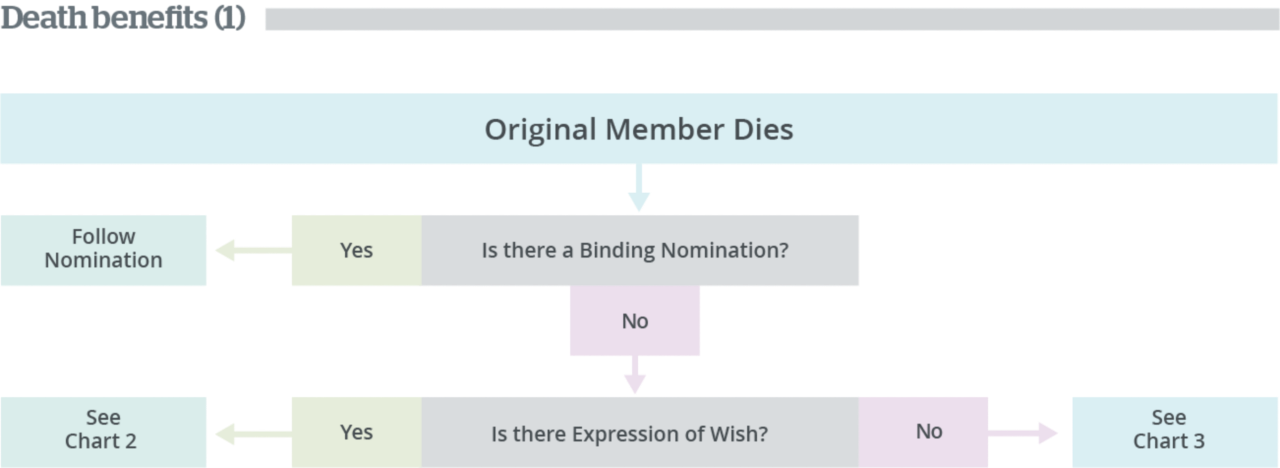

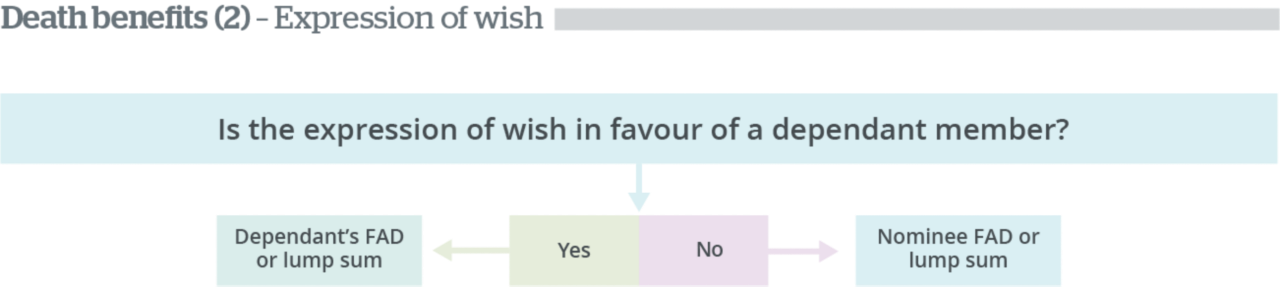

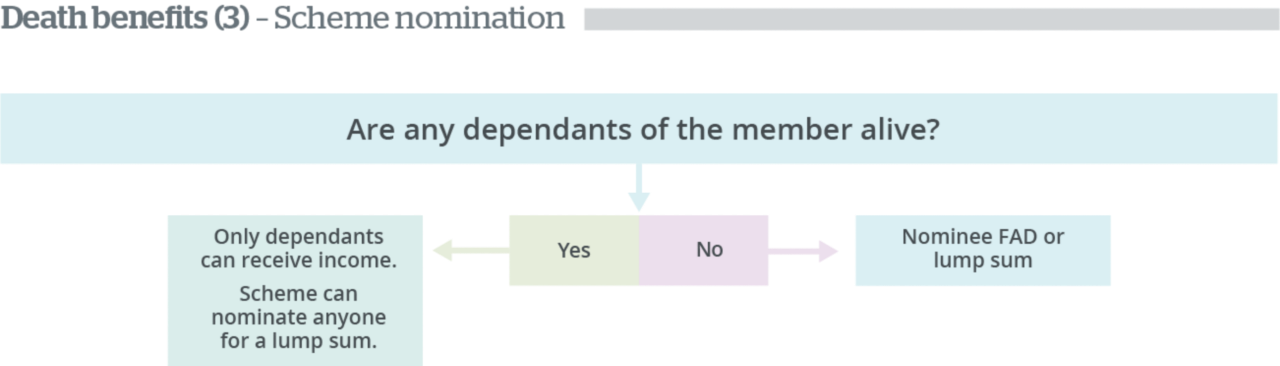

However, what can be paid out depends on who is going to receive it as the following diagrams explain.

Death benefits - Expression of wish

Death benefits - Expression of wish

Death benefits - Scheme nomination

Death benefits - Scheme nomination

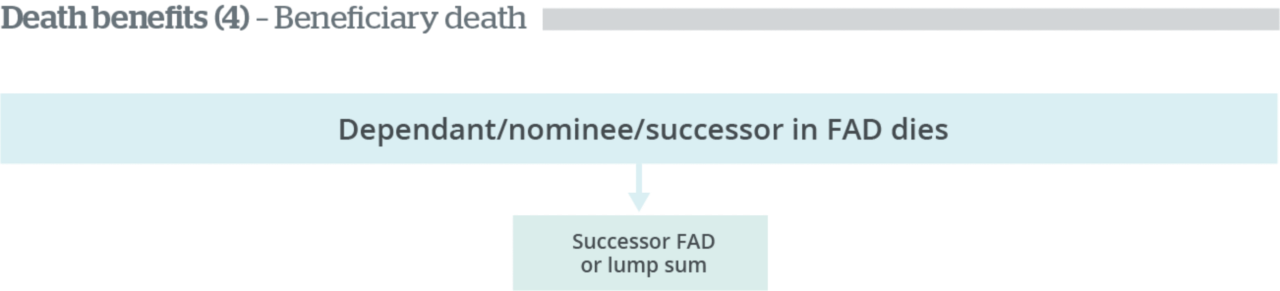

Death benefits - Beneficiary death

Death benefits - Beneficiary death

It is essential that clients are aware of the way the law works. If a member has a separated spouse and two adult children but dies without an expression of wish form filled in, then the provider will be restricted. Evidence could be received that they would not want the separated spouse to receive any benefit but would instead want their children to benefit. However, as the separated spouse is technically a dependant and the children are not, all the children could receive is a lump sum which may not be the most tax-efficient.

In addition, as mentioned above, although the law can allow full flexibility of death benefits this is conditional on the scheme rules allowing this and may not actually happen in practice.

Occupational schemes

Occupational money purchase schemes often do not offer the full range of death benefits. They will usually provide lump sum death benefits (payable in addition to the value of the pension fund). The lump sum

- may be calculated as a multiple of earnings (as for defined benefit schemes) or a fixed amount, and

- may have been set at a level that allows scope to buy a dependant's pension (as well as paying some lump sum).

- generally, is the value of the uncrystallised fund at the point of death. On death, the pension fund can be used to provide a lump sum death benefit and / or dependant's pension benefits, with the lump sum (up to the member's unused lump sum death benefit allowance) being the usual choice.

A member will get details of the death benefits in the pension scheme booklet, yearly statements, or by contacting their scheme trustees. An employer is required to provide pension provision to satisfy their auto-enrolment duties. If an employer doesn't provide an occupational type pension scheme for their employees they may provide group personal pension or group stakeholder plans. In addition they may provide separate death in service benefit cover, perhaps via a group life plan – more of this later.

Post-crystallisation, the death benefits provided will depend on how benefits were put into payment (crystallised) and the terms of the plan. The main options offered at crystallisation may include:

- a scheme pension

- a lifetime annuity

- flexi-access drawdown (or in some cases capped drawdown).

The benefit offered at crystallisation depends on the type of scheme. DC schemes may offer a scheme pension (although this is unusual and more information on scheme pension can be found in our Death benefits for defined benefits article), paid either by the scheme directly or via an insurance company selected by the scheme administrator. Before offering a scheme pension the member must be given the opportunity of selecting the option of a lifetime annuity. If the member wishes to access options not offered by their particular scheme, they would have to transfer to an alternative scheme.

Death benefits – group life schemes

Employees often have death in service cover as part of their contract of employment with typically '3-4 times their salary' as the benefit, but sometimes higher (to allow members' beneficiaries to use part of the lump sum to provide a dependant's / beneficiary's pension). Pensions legislation has a dramatic effect on the way in which death in service benefits are designed and delivered in the UK. Group life cover is a way of providing death benefit while a member is still employed by the company – usually paid as a lump sum. These benefits must be within limits set out in the scheme rules.

Although underwriting may be necessary, most large schemes which offer group life assurance have a free cover limit – strictly speaking, 'an automatic cover level'. This offers:

- life cover without providing medical evidence. Therefore no underwriting is required below certain amounts. Usually the employee must join the scheme at their first opportunity and be actively at work (not off sick) at that point

- life cover at standard rates below certain limits.

This is possible because the membership of group schemes would provide a large pool of people to spread the risk across. Exemptions from underwriting would also reduce administration costs.

The cost of life assurance premiums is usually decided on a 'single premium' basis. This means that the cover is valid for a year and is renewed each year. The premiums may also go up as the member gets older (as the average risk of dying increases).

Underwriting is the process by which the insurer decides to accept or decline applications for life cover (and health insurance and some annuities) on the basis of the medical history information provided.

Individual plans

The death benefits provided by individual plans such as retirement annuity contracts, personal pensions, stakeholder pensions etc. are different from those provided by an occupational scheme. However, they may still not offer the full flexibility described above.

Generally, the death benefit from individual pension plans is based on the value of the pension fund at the point of death (as opposed to being defined by the scheme rules). On death pre-crystallisation, the pension fund can be used to provide a lump sum death benefit and / or beneficiary income. Some older type plans, such as early retirement annuity contracts, build a deferred annuity rather than a fund of money at retirement. For these, the death benefit may be expressed differently (return of premiums, with or without interest, etc.) Alternatively, the "fund equivalent" of a deferred annuity may be calculated.

In the past, it was possible to link additional life cover directly to personal pensions (PPs, stakeholder and the group versions of these plans). This additional life cover was called pension term assurance and provided a lump sum over and above the value of the pension pot. However, in April 2007, HMRC withdrew tax relief on new pension term assurance. So if an individual pension holder's circumstances dictate a need for a lump sum on death, they should address this need outside their pension arrangements. If pension term assurance was linked to an individual pension before April 2007, this additional cover can continue (providing no material changes are made) and will provide an additional lump sum on death, depending on the terms and conditions of the policy.

The Lump Sum and Death Benefits Allowance (LSDBA)

Death benefits paid when the member died:

- under age 75 and were set up outside of two years of the scheme becoming aware of the members death, or

- aged over 75 are not tested against the LSDBA.

These benefits, however settled will be subject to the recipients marginal rate of tax (if settled into beneficiaries drawdown this is only taxed when taking income from that drawdown pot).

For deaths where the member died before age 75 and settled within the two years of the scheme becoming aware of the members death the treatment can depend on the way the benefits are settled.

If the benefits are settled as a form of beneficiaries income (beneficiaries drawdown or beneficiaries annuity) these are not tested against the LSDBA, as these are not lump sum death benefits.

If the benefits have been settled into beneficiaries drawdown then any withdrawals are taxed as pension income - even if it is 100% of the fund. Whilst this may have the feel of a lump sum payment, it’s a drawdown income payment. As this was from a member who dies pre-75 and settled within 2 years of the scheme becoming aware of the members death this drawdown payment is not subject to income tax.

Lump sum payments from uncrystallised funds to a beneficiary will be tested against the members available LSDBA, with any excess subject to the beneficiaries marginal rate of tax.

Lump sum death payments from crystallised funds will be tested against the LSDBA if these funds were crystallised on or after 6 April 2024. Again with any excess over the members available LSDBA being taxed at the recipients marginal rate of taxation. A similar principle applies to lump sums paid from beneficiary pots.

Lump sum payments from funds that were crystallised before 6 April 2024 will not be tested against the LSDBA.

You can read more about LSDBA in our article.

Paying the LSDBA excess tax charge

Death benefits can be paid to more than one beneficiary. But, even if the benefit is split to a number of beneficiaries, the total lump sum death benefits to all the beneficiaries still needs to be checked against the LSDBA.

It is the personal representatives responsibility to notify HMRC if excess charges are due. Pension schemes will pay out the benefits gross.

HMRC guidance states that the reason for treating the BCEs as occurring simultaneously is to ensure that where more than one relevant post-death BCE occurs following the member's death, any arising LSDBA charge liability is allocated fairly where there are two or more recipients. This is an issue where the member/beneficiary has some available LSDBA at the point of death.

The tax charge liability of each recipient is apportioned by HMRC on a 'just and reasonable' basis. The guidance suggests the personal representatives would decide the order the death benefits are to be paid in but there seems to be no practical implications of this given HMRC state they will split the tax equitably.

Charity lump sum death benefit

A charity lump sum death benefit is, as it suggests, a lump sum paid to a charity on the member or beneficiary’s death. A member may express a wish for a charity to receive some of their death benefits but in addition a lump sum death benefit may also be left to a registered charity free of tax provided:

a) no dependants of the original member are alive

b) the member or if the member hasn't nominated, the dependant / nominee / successor nominated the charity.

The charity must be one that is registered with the Charity Commission for England & Wales (www.charitycommission.gov.uk) or their Scottish (OSCR) or Northern Ireland counter-parts and they must use the payment for charitable purposes.

The conditions for payment are:

Death of a member

sum is paid on the death of the member

there must be no dependants of the member

- sum is paid in respect of drawdown pension funds

- sum is paid to a charity nominated by the member

or

for payments before 16 September 2016 the member died having reached age 75 (for payments on or after that date there is no restriction on the age of the member)

there are no dependants of the member

- the member had relevant uncrystallised funds under a money purchase arrangement when they died, and

- the sum is paid to a charity nominated by the member.

Paragraph 15(2B) Schedule 28 and paragraph 18 Schedule 29 Finance Act 2004

Death of a beneficiary

A lump sum is a charity lump sum death benefit if the following conditions are met:

- sum is paid on the death of a beneficiary

- there are no dependants of the member at the time of the payment

- sum is paid in respect of either:

- a dependant’s drawdown pension fund at the date of the dependant’s death in respect of an arrangement relating to the member, or

- a nominee’s / successor’s flexi-access drawdown fund at the date of their death in respect of an arrangement relating to them as a nominee/successor

- a dependant’s drawdown pension fund at the date of the dependant’s death in respect of an arrangement relating to the member, or

- sum is paid to a charity nominated by the member or if the member made no nomination by the deceased beneficiary.

The maximum amount of charity lump sum death benefit must be no more than the value of the arrangement at the time of the payment.

A charity lump sum death benefit is paid tax-free. However if not used for charitable purposes the payment is treated as an unauthorised payment. Payment of a charity lump sum death benefit is not a benefit crystallisation event. The two-year rule for payment of death benefits will not apply if it is paid to a charity.

Nominations

The member can nominate the charity to which the payment is made.

The member can make a number of nominations depending on the circumstances that exist at the time of their death. If there is a dependant alive at the time of the member's death, the remaining funds must be used to provide that dependant with a pension death benefit, but the member can still nominate in advance what happens to any remaining funds if that dependant then dies. Where the member does not nominate, or the member's nomination becomes void (eg the charity ceases to exist) the dependant can nominate, but the dependant cannot override a member's nomination.

The scheme administrator cannot choose the charity receiving the payment.

Para18, schedule 29, Finance Act 2004

Winding-up lump sum death benefit

This payment type was removed 6 April 2015.

Pensions Tax Manual - PTM073800

GMP (MP scheme with GMP underpin)

The GMP would have been paid to the member as a pension at vesting and as such would not form part of the drawdown pension fund. If the member dies with a surviving spouse / civil partner, a spouse's GMP would become payable, which could, potentially, be commuted for a trivial commutation LSDB. If the member dies with no surviving spouse, then there is no requirement to continue paying a GMP.

Tech Matters

Ask an expert

Submit your details and your question and one of your Account Managers will be in touch.