Firm Level |

All firms conducting transfers or conversions require transfer permissions |

|

Individual Level |

PTS Required

|

No PTS Required

|

Pensions

Pension transfers and conversions

Last Updated: 6 Apr 25 34 min read

Contents

1. Key Points

2. Background

3. What is a pension transfer and pension conversion?

5. Permission required to conduct transfer business

6. When is a pension transfer specialist required?

8. Appropriate Pension Transfer Analysis (APTA)

10. Pension transfer specialists

12. Defined Benefit to Defined Contribution transfer

14. Insistent client

15. TVC

16. Charging

We explore the advantages and disadvantages of transferring a Defined Benefit scheme to a Defined Contribution type scheme and the assessment process, including Appropriate Pension Transfer Analysis (APTA) along with its mandatory Transfer Value Comparator (TVC).

The FCA have published several Consultation Papers and Policy Statements since March 2015, to deal with the introduction of Pensions Freedoms and to improve the quality of pension transfer advice. Here is a list of the main publications;

- Consultation Paper CP15/7 – Proposed changes to our pension transfer rules, March 2015

- Policy Statement PS15/12 – Feedback on CP15/7 and final rules, June 2015

- Consultation Paper CP17/16 – Advising on Pension Transfers, June 2017

- Policy Statement PS18/6 – Feedback on CP17/16 and final rules and guidance, March 2018

- Consultation Paper CP18/7 – Improving the quality of pension transfer advice, March 2018

- Policy Statement PS18/20 – Feedback on CP18/7 and final rules and guidance, October 2018

- Consultation Paper CP19/25 - Pension transfer advice: contingent charging and other proposed changes

- Policy Statement PS20/6 - Feedback on CP19/25 and our final rules and guidance

- Guidance Consultation GC20/1 - Advising on pension transfers

- Finalised Guidance FG21/3 - Advising on pension transfers

Key Points

- A pension transfer involves giving up safeguarded pension benefits in return for a cash value which is invested in another pension scheme.

- A pension conversion involves giving up safeguarded pension benefits in return for access to flexible benefits, or payment of an uncrystallised funds pension lump sum.

- Firms who wish to carry out pension transfer or pension conversion business must have FCA transfer permissions

- It is vital that advisers understand the differences between switches, conversions and pension transfers as it drives the whole advice process thereafter

- Advisers must understand what ‘safeguarded’ benefits are to fulfil regulatory requirements, undertake the advice process properly, and ensure the appropriate process is followed for pension transfers and conversions.

Background

There is a difference between the Financial Conduct Authority (FCA) requirements for advising on a pensions switch, conversion or transfer. Also there are particular HMRC legislative requirements for the process of transferring.

This article focuses on the FCA requirements in respect of a transfer or conversion from an Occupational Pension scheme to a Defined Contribution scheme (including DB to DC transfers).

A pension switch is where a transaction is not within the definition of pension transfer, but involves moving pension benefits from one scheme to another scheme, of the same type. For example, where a retail client is transferring benefits from a personal pension or stakeholder pension scheme where there are no safeguarded benefits (and where there has been no previous transfer from a defined benefits scheme) to another personal pension/stakeholder pension scheme. Details are contained within our Pension Switching article.

For details on transferring to or from an overseas pension scheme please refer to our article on Qualifying Recognised Overseas Pension Scheme.

The focus of the FCA’s requirements is to ensure that individuals switching, converting or transferring their pension arrangements receive the appropriate level of advice, provided by advisers who have sufficient knowledge to ensure the client understands the implications of the proposed action. This is especially important where there is potential for significant consumer harm if unsuitable advice is given to consumers who are considering giving up “safeguarded benefits”.

All parties involved with these transactions have a duty of care to the client to ensure that clients receive the appropriate advice, as these transactions can have a very significant impact on a client's future financial welfare. Please also see the article Transferring a pension scheme which you may find helpful.

Following consultation, the FCA issued Policy Statement (PS15-12) addressing changes to the rules on pension transfers, necessary as a result of Pensions Freedom. This policy statement came into force on 5 June 2015.

This has since been followed up by PS18/6 and PS18/20.

What is a pension transfer and pension conversion?

A pension transfer is the movement of safeguarded benefits to flexible benefits in a different scheme, as well as certain transfers of safeguarded benefits to other safeguarded benefits (such as transfers from safeguarded benefits in occupational schemes to safeguarded benefits in non-occupational schemes).

A pension conversion is defined as a transaction resulting from a decision of a retail client to require the trustees or managers of a pension scheme to:

- convert safeguarded benefits into different benefits that are flexible benefits under that pension scheme; or

- pay an uncrystallised funds pension lump sum in respect of any of the safeguarded benefits

Safeguarded benefits

In the definitions above, the term safeguarded benefits are referred to within both pension transfer and pension conversion. So what are safeguarded benefits?

In the Pensions Schemes Act 2015 (section 48(8)) safeguarded benefits means benefits other than:

- money purchase benefits, and

- cash balance benefits.

For the purpose of the above definition a money purchase arrangement is a scheme where the benefit, rate or amount of income payable is calculated solely by reference to the scheme assets. As such, for an arrangement to be exempt from the definition of safeguarded benefits, it cannot contain any guaranteed annuity rates or guarantees of the level of income that will be paid.

Cash Balance Benefits are calculated by reference to an amount available for the provision of benefits to or in respect of the member (“the available amount”) where there is a promise about that amount. The promise includes, in particular, a promise about the change in the value of, or the return from, payments made by the member or any other person in respect of the member.

But a benefit is not a “cash balance benefit” if, under the scheme:

(a) a pension may be provided from the available amount to or in respect of the member, and

(b) there is a promise about the rate of that pension, including:

- the available amount will be sufficient to provide a pension of a particular rate;

- the rate of a pension will represent a particular proportion of the available amount.

In other words, a cash balance plan may provide a promised growth rate on the contributions, but does not provide any promise with regards to the rate of conversion of the fund at crystallisation.

Therefore, if the only exclusions from the definition of safeguarded benefits are the above definitions of money purchase and cash balance, any other type of benefit will be regarded as safeguarded benefits, including:

- Defined Benefit schemes

- Any guaranteed annuity rate (we cover rules for GARs later)

- Any deferred annuity rate

In January 2016 the Department for Work and Pensions (DWP) issued the factsheet Pension benefits with a guarantee and the advice requirement (PDF) in which they sought to further clarify what constituted safeguarded benefits. In the factsheet it states that safeguarded benefits are defined in legislation as pension benefits which are not money purchase or cash balance benefits. In practice, safeguarded benefits are any benefits which include some form of guarantee or promise during the accumulation phase about the rate of secure pension income that the member (or their survivors) will receive, or will have an option to receive. These include:

- Under an occupational pension scheme, a promised level of income calculated by reference to the member’s pensionable service in the employment of the pension scheme’s sponsoring employer (for instance, under a final salary scheme)

- A promised level of income (or guaranteed minimum level of income) calculated by reference to the contributions or premiums paid by or in respect of the member (for instance, under some older personal pension policies)

- A promised minimum rate at which the member will have the option to convert their accumulated pot or fund into an income at a future point, usually on the member reaching a particular age (generally known as a guaranteed annuity rate, or guaranteed annuity option).

In November 2017 (and updated February 2018), DWP issued “Safeguarded-flexible pension benefits: simplified valuation and introduction of personalised risk warnings”. One of the key requirements this introduced is for relevant risk warnings to be provided at least 2 weeks before the transfer of safeguarded benefits transaction takes place. Effectively this means such transfers must not be completed within this 2 week period.

Permission required to conduct transfer business

Before we look at Permissions, we should mention the triage process and where this may actually constitute a personal recommendation.

Triage needs to be restricted to generic, factual information about the advantages and disadvantages of safeguarded benefits and flexible benefits and at no point take into account the client’s personal circumstances.

Firms who wish to carry out pension transfer or pension conversion business must have FCA transfer permissions. If a firm does not have the relevant permission, they cannot undertake this activity. This rule is driven by amendments to the Regulated Activities Order in April 2015 and means that firms now require pension transfer permissions to be able to transact any pension transfers or pension conversions, even where a firm is not dealing with safeguarded benefits or providing the services of a pension transfer specialist.

Pension conversion includes:

- Conversion of safeguarded benefits into flexible benefits within the same scheme, and

- Payment of an Uncrystallised Funds Pension Lump Sum (UFPLS) in respect of safeguarded benefits

This meant a number of firms who conducted pension transfer/pension conversion business in the past, were no longer allowed to do so unless they applied for and obtained the required permission.

For the avoidance of doubt, although the Department for Work and Pensions states that under £30,000 a ceding scheme does not have to ensure that a member has received advice, the FCA has no such ruling. Where an adviser is involved with the transfer or conversion of a pension they need to be appropriately authorised and qualified, irrespective of the value of the pension.

For pension opt-outs, the above applies where the firm will be recommending a FCA-regulated replacement scheme.

If a firm recommends opting out, but there is no redirection of the premiums to a FCA-regulated replacement scheme associated with the advice then this is not regulated advice. However, advisers still have an overarching responsibility to act in the clients best interests regardless of the fact it's not regulated advice. Therefore advisers should take care when giving advice on DB benefits and advising on opt-outs.

Pension Sharing on Divorce

In PS20/6 the FCA stated the following when looking at pension sharing on divorce cases “The Department for Work and Pensions (DWP) have confirmed to us that pension sharing orders are not covered by the requirement to take ‘appropriate independent advice’. In our view, this means that advisers are only advising on where the funds will be invested, not on the transfer itself.

This was followed up in FG21/3 when the FCA stated “you do not need the permission if you advise an ex-spouse whether to use a pension credit awarded from a pension sharing order to acquire rights in a DB scheme. DWP has told us that where the ex-spouse has the option of becoming a member of a DB scheme, the pension credit is not regarded as safeguarded benefits (or money purchase or cash balance benefits) or a transfer payment but as a right in itself. If you advise an ex-spouse on using the pension credit to acquire rights in a DB scheme, this falls outside FCA-regulation. But if you advise them on acquiring rights in an FCA-regulated DC scheme, you must have the relevant investment advice permission.

Therefore, when giving advice on pension sharing cases from a scheme with safeguarded benefits, there is no regulatory requirement to have transfer permissions or have a pension transfer specialist sign off the advice. However, for those looking to advise it may be worth speaking to their compliance team to see if they would want a pension transfer specialist involved.

Charges for advice about the receiving arrangement for a pension credit awarded under a pension sharing order are not included within the contingent transfer ban covered later.

When is a pension transfer specialist required?

The FCA rules require that advice on pension transfers or conversions (from a scheme with safeguarded benefits or potential safeguarded benefits). must be provided by, or checked by, a pension transfer specialist and firms wishing to provide advice on pension transfers and pension opt-outs must apply for and obtain special permission to carry out that activity.

For pension opt-outs, the above applies where the firm will be recommending a FCA-regulated replacement scheme. As stated earlier, if there is no redirection of the premiums to a FCA-regulated replacement scheme no permissions are needed, and as such no PTS is required.

A PTS is not required where the safeguarded benefit involved is a guaranteed annuity rate.

Pension transfer specialist

Abridged Advice

As of 1 October 2020 abridged can be given, this is a short form of regulated advice that can be given for pension transfers and conversions that require a PTS.

There are only 2 possible outcomes that can be given under the abridged advice route;

- Provide the consumer with a personal recommendation not to transfer or convert their pension. or

- Tell the consumer that it is unclear whether they would benefit from a pension transfer or conversion based on the information collected through the abridged advice process. The adviser must then check if the consumer wants to continue to full advice, and if they understand the associated costs.

Abridged advice will only cover the initial stages of the full advice process, including a full fact-find and risk assessment. Firms must not undertake APTA, provide a TVC or consider the consumer’s proposed receiving scheme. If firms undertook these processes as part of abridged advice, they would effectively be giving full advice. As abridged advice does not consider how funds might be invested if a transfer proceeded, firms must not assess the risks associated with a specific flexible arrangement.

Firms do not need to offer abridged advice but, when they do, it must be carried out (or checked by) a PTS and that firms must provide a suitability report for advice not to transfer.

If a consumer chooses to continue to the full advice process advisers/firms will need to offset the abridged advice charge from the full advice charge (unless a client uses different advisers for abridged advice and full advice).

Appropriate Pension Transfer Analysis (APTA)

APTA

From 1 October 2018, the Transfer Value Analysis System (TVAS) was replaced with the Appropriate Pension Transfer Analysis (APTA).

One of the stated aims of the APTA is to help “prove” suitability. It removes the, often confusing, TVAS analysis and replaces this with an APTA which would set out the minimum level of analysis expected for income and death benefits. APTA should detail any “trade-offs” that have to be made for objectives against needs. Part of this process will be the inclusion of a prescribed comparator (TVC – see later) providing a financial indication of the value of benefits being given up.

The regulator has left APTA design mostly at the discretion of the adviser (bar the TVC) to decide how this should look and what should be incorporated. Advisers will be best placed to assess the needs and circumstances of their individual clients.

In terms of contents this can include:

- Both behavioural and non-financial analysis, as well as considering alternative ways of achieving client objectives

- Use of modelling tools, however, advisers should consider the part these tools play in explaining the options to individual clients.

- Death benefit comparison

- Overseas transfer comparisons

The APTA can also be used for self-investing clients, although this does not reduce the need for the PTS to fully inform the client on their intended investment choices.

There are also the following considerations that need to be factored in;

- advisers must consider the impact of tax and access to state benefits, particularly where there would be a financial impact from crossing a tax threshold/band

- the APTA must consider a reasonable period beyond average life expectancy, particularly where a longer period would better demonstrate the risk of the funds running out

- advisers must consider trade-offs more broadly and not just income v death benefits

- consider the safety nets – the PPF and Financial Services Compensation Scheme (FSCS) in the UK – that cover both the current and receiving schemes in a balanced and objective way

- if information is provided on scheme funding or employer covenants, it should be balanced and objective

Guaranteed Annuity Rates

There is one significant exception to the requirement for a pension transfer specialist, and it is where the advice is on conversions or transfers in respect of pension policies with a guaranteed annuity rate (GAR).

Although GARs are safeguarded benefits, the FCA do not require these cases to be checked by a pension transfer specialist. The firm advising must have the full or limited transfer permission but the advice can be provided by an adviser with investment advice permission. This is because an adviser with the investment advice permission, but not the pension transfer and opt-out permission, must still prominently highlight the value of the GAR to their client (the firm still needs to hold transfer permissions). The adviser should do this as part of the suitability assessment report for their client.

As of 1 October 2020 the FCA have clarified the rules for Guaranteed Annuity Rates to include a minimum guaranteed income (a contract feature most often seen in Retirement Annuity Contracts (RACs)).

This easement for minimum guaranteed income excludes fixed or guaranteed benefits in an individual pension contract that replaced similar safeguarded benefits under a defined benefits pension scheme. It also excludes entitlements to a lifetime income paying a GMP that results from contracting out of the State Earnings Related Pension Scheme and a defined benefit minimum that accrues or may accrue at the same time as money purchase benefits under a pension arrangement. As there is more complexity in assessing and advising on these arrangements, so advice must be given (or checked) by a PTS and include a TVC and APTA.

Pension transfer specialists

Currently, a pension transfer specialist must have CF30 (customer function) and hold a qualification from:

- G60 or AF3 (CII)

- Pensions paper of Professional Investment Certificate (IFS)

- Fellow/Associate of Pensions Management Institute

- Fellow/Associate of Faculty of Actuaries

From October 2021 FCA requires PTSs to hold the level 4 RDR qualification for advising on investments (or equivalent by other existing qualifications and gap-fill exercises) before they can advise on or check pension transfer advice.

Full details of the qualifications accepted are available in the FCA Training and Competence Handbook. The FCA heavily discourage direct offer or execution only in pension transfers and if this is to take place then the firm must make, and retain indefinitely, a clear record that no advice was given.

The FCA Handbook text reflects that they expect a PTS to:

- check the entirety of the advice process, not just the numerical analysis, and consider whether the advice is sufficiently complete

- confirm that the personal recommendation is suitable

- inform the firm in writing that they agree with the advice, including any recommendation, before the report is given to the client

For any two-adviser models, this means that any disagreements between the PTS and the adviser must be settled before the client is given the suitability report.

Continuing Professional Development (CPD) Requirements

As of 1 October 2020, a PTS must undertake 15 hours of CPD (this is in addition to any other continuing professional development that is required (such as the 35 hours for a retail investment adviser). This must include 9 hours of structured CPD and at least 5 hours of this structured CPD must be provided by an external independent provider.

PTSs can elect the start of their PTS CPD year and so may align it with other existing CPD years, such as retail investment adviser CPD. Firms may use various formats for PTS CPD such as incorporating a form of testing or implementing mentoring systems

COBS requirements

COBS has detailed requirements (COBS 19.2) which must be followed before a pensions transfer specialist can advise on a transfer. The firm has to:

- Consider the current Workplace Pension Scheme (WPS) as a destination for the transfer as the default fund (if available) should be appropriate for all members without the need for ongoing advice. If the WPS is not being recommended it must be detailed why any other scheme is more suitable (not simply as suitable) as the WPS. More on this below

- ; and

- give the client enough information to make an informed decision but also try to make sure that the client understands the comparison and the advice given. More on understanding below.

Workplace Pension Schemes (WPS)

The FCA have clarified that it is the current WPS that must be considered, if the recommended destination for the transfer is not the WPS then the firm must demonstrate why the alternative is more suitable than the WPS. There are examples in COBS 19.1.6 as to where an alternative scheme could be viewed as more suitable, one example is the client needing access to the funds within 12 months of the transfer using a decumulation option that would not achieve their desired outcome (e.g. the WPS may not offer drawdown which is what the client requires).

Firms can also consider a previous WPS if it would be more appropriate to do so, e.g. if the most recent WPS does not accept additional contributions or if a consumer is not an active member of a WPS at the time.

The FCA feel that many consumers would not benefit from ongoing advice as their circumstances are unlikely to change significantly from year to year. These consumers will be more suited to the default WPS fund. Where ongoing advice is needed and would add value for the consumer, the FCA expect firms to consider this as part of the recommendation, including the option of paying ongoing adviser charges directly rather than via the scheme.

The FCA consider that using standard paragraphs to dismiss WPSs as a matter of course in suitability reports is unlikely to comply with the rules. For example stating that privacy from the employer will not be acceptable as the FCA have stated that there is already legislation in place to separate the employer from the WPS to ensure the member’s privacy. All firms will need to change their processes to be able to undertake the required analysis in the APTA and recommend a WPS where it is as suitable.

Firms that use panels or are restricted, including VIFs are not prevented from making an off-panel recommendation. If affected firms cannot accommodate this change, they may wish to consider how to restrict advice to those consumers where an available WPS is not a consideration.

Suitability Reports and Customer Understanding

As part of enhancing disclosures to clients from 1 October 2020 a suitability report must include a 1 page summary at the front (this is limited to one side of A4). This must be personalised to the clients individual circumstances and include;

- The current level of the guaranteed income being given up

- Charges disclosure: including ongoing advice and all product charges they expect to levy in the first year if a transfer or conversion goes ahead.

- The adviser’s recommendation: which clearly sets out whether the consumer should transfer or convert their pension or not.

- Pension risk: a statement on the risks of the pension transfer or pension conversion.

- Ongoing advice: information about any ongoing service provided, if the adviser proceeds with the pension transfer or pension conversion.

This disclosure must also show the comparison with the WPS, where applicable and any other scheme that may be recommended.

Additionally firms must ensure that clients understand the transaction proposed. Financial advisers are responsible for explaining the risks of proceeding with a pension transfer or conversion in a way the consumer can understand and, in line with our new rules, demonstrating that the consumer understood the explanation. A similar summary is required for abridged advice.

Firms can also consider a previous WPS if it would be more appropriate to do so, e.g. if the most recent WPS does not accept additional contributions or if a consumer is not an active member of a WPS at the time.

The FCA feel that many consumers would not benefit from ongoing advice as their circumstances are unlikely to change significantly from year to year. These consumers will be more suited to the default WPS fund. Where ongoing advice is needed and would add value for the consumer, the FCA expect firms to consider this as part of the recommendation, including the option of paying ongoing adviser charges directly rather than via the scheme.

The FCA consider that using standard paragraphs to dismiss WPSs as a matter of course in suitability reports is unlikely to comply with the rules. For example stating that privacy from the employer will not be acceptable as the FCA have stated that there is already legislation in place to separate the employer from the WPS to ensure the member’s privacy. All firms will need to change their processes to be able to undertake the required analysis in the APTA and recommend a WPS where it is as suitable.

Firms that use panels or are restricted, including VIFs are not prevented from making an off-panel recommendation. If affected firms cannot accommodate this change, they may wish to consider how to restrict advice to those consumers where an available WPS is not a consideration.

Cashflow Modelling

Whilst not mandated, from 1 October 2020 where a firm chooses to use cashflow modelling this must be done in real terms and use reasonable assumptions for tax bands and limits. This must also include reasonable stress tests on the pension investment value.

The use of real terms is intended to make the outputs easier for consumers to understand, as they will not need to account for inflation.

There are specific inflation rates that firms should use when converting monetary terms to real terms.

Stress testing is mandatory however specific test have not been specified as the FCA consider firms are best placed to consider the most relevant stress testing scenarios for their client.

Defined Benefit to Defined Contribution transfer

As mentioned above, in many cases it is not appropriate to do a DB to DC transfer, as the safeguarded benefits available in a DB scheme may be difficult to replicate in a personal pension.

A partial transfer of a DB scheme may be possible and in many ways could provide the ideal mix of secure DB benefits to provide for core retirement needs, linked with the flexible options offered by DC arrangements. Unfortunately many schemes still leave members with an ‘all or nothing’ choice.

However, there are some circumstances where it may be advantageous. The following highlights some of the advantages and disadvantages of transferring a DB scheme, these include:

- An employer/scheme may offer an incentive to move from the DB scheme. This may be in the form of an enhanced transfer value. The trustees may seek to do this to reduce the liabilities of the scheme. However, even taking this enhancement into account, it is still often not appropriate to transfer and may even result in the loss of Lifetime Allowance protection for those who applied for protection after 15 March 2023.

- Flexibility: a DB scheme does not offer the same flexibility as a Personal Pension scheme. For example, Income Drawdown is not an option under a DB scheme. Drawdown would give the client the ability to select and change the level of income they draw from their pension, allowing them the opportunity to change their income to meet changing income requirements and perhaps manage their tax liability by reducing liability to higher rates of tax. Under their DB scheme the scheme dictates the income being paid usually without any option to vary. However, by transferring the client would thereafter be taking on the longevity, investment and benefit payment risk which previously sat with the DB scheme.

- Flexibility as to when the member wishes to take benefits, e.g. the DB scheme may have a retirement age of 65 and will not permit early retirement, other than with the scheme trustees’ or employer’s consent, and say, the client wishes to retire at age 60. Even if early retirement is allowed a significant actuarial reduction may be applied. However, it may be appropriate that alternative short term funding for early retirement (until the DB entitlement is available) should be considered.

- Flexibility: Within a DB scheme the available tax free lump sum may only be able to be taken, in full, at the point the client takes the benefits from the scheme. Within a DC arrangement the client can decide to phase the payment of the tax free lump sum by only crystallising the portion of the funds required to generate the lump sum required (with associated designation to income product). This ability to take only part of the available benefits may assist in the deferment of any possible LTA charge.

- There may be potential for a higher annuity through a Personal Pension (for example if the DB scheme pension provides benefits such as spouses/civil partner’s pension and the member doesn’t have a spouse/civil partner, or the spouse/civil partner already has sufficient pension provision). However, clients in this position must consider that their marital status may change in the future.

- There may also be a possibility of a client accessing enhanced/impaired life annuity rates if they transfer to a Personal Pension. DB schemes do not consider health/lifestyle issues when establishing the level of income to be paid. Enhanced/impaired life annuities provide higher levels of income than standard annuities, reflecting health or lifestyle issues that may have an impact on a client’s longevity. A comparison between their DB benefits and an enhanced/impaired life annuity, which provides a rate of income that reflects a client’s medical situation, may be appropriate.

- The level of death benefits provided by the DB scheme may not be reflective of the fund value of the scheme if it was transferred (this may be especially marked in deferred DB pensions where, unless there is a dependant, the scheme may only pay a small multiple of the deferred pension (for example 4/5 times deferred pension). However, consideration of alternative protection options (life cover etc.)should be undertaken before giving up the protected benefits in a DB scheme just so that death benefits are increased.

- Within a DB scheme there is no control of the death benefits, these are paid in line with the scheme rules with little ability for the recipient to manage these payments. After retirement it is likely that the DB scheme will only pay dependants pensions with children and step children that are above age 23 no longer classed as dependant (barring physical or mental impairment). Within a DC scheme, the client can nominate who they would like the death benefits to be paid to. They could nominate their spouse, children or even grandchildren all to receive a share of their death benefits. Although the discretion of who will be paid death benefits usually lies with the trustees of the pension (usually required to keep the funds IHT free), if the client lets them know their wishes (via a nomination/expression of wish) they will take these into account and may reach a decision to follow the clients request. Without a nomination, the trustees are likely to pay all the death benefits to dependants. If in the unlikely event the trustees did elect to pay non-dependent children a portion of the death benefits, if there is no nomination in place, they can only pay a lump sum to non-dependants (such as independent children over the age of 23). Ensuring that clients put a nomination in place (and keep it up to date) is vital. The recipient of a DC death benefit can usually decide to take the benefits as a lump sum, use the funds to buy an annuity, or they can place the funds within a dependants/nominees (and subsequently successors) drawdown. If the beneficiaries elect flexi-access drawdown they can choose if, when, and how much they choose to draw down from these funds. Thereafter, the dependant/nominee flexi-access holder nominates who they wish the funds to be subsequently left to. So, if the funds are left solely to a spouse, there is no control over who they might leave the assets to; they may not leave funds to the original member's bloodline and could possibly leave everything to say a new spouse, with the member’s children receiving nothing. Spousal Bypass Trusts are one way in which this issue can be addressed. Getting advice in this area is vital.

- Although the tax treatment of DB and DC death benefits on death post 75 is the same, there is a significant difference when death occurs before age 75. On death before age 75 although lump sum death benefits from both DB and DC schemes and income benefits from DC schemes are tax free, income benefits from DB schemes are taxable at the recipients’ marginal rate. The tax treatment and lack of control attached to DB death benefits (as detailed above) will result in the recipient of DB income death benefits paying more tax (and perhaps a higher rate of tax) than could have been achieved within a DC scheme.

- The DB scheme may be in danger of entering the Pension Protection Fund (it is very important that the implications of this and how the PPF works are fully understood.

Disadvantages include:

- On transferring from a DB to DC scheme, the client will take on the investment, longevity, income management risk etc. as previously detailed. This also applies to any dependant’s benefits payable from the DB scheme.

- Transferring clients may become vulnerable to various pension liberation schemes/scams.

- With control comes responsibilities – the client needs to ensure that they exercise sufficient self-control to manage the withdrawal options they have within a DC arrangement.

- The protection of the Pension Protection Fund would be lost on transfer of a DB scheme to a DC arrangement. The PPF was established to pay compensation to members of eligible defined benefit pension schemes, when there is a qualifying insolvency event in relation to the employer and where there are insufficient assets in the pension scheme to cover Pension Protection Fund levels of compensation. The PPF provides on-going protection at a level which may provide the client with sufficient retirement benefits.

- As an opted-out member of the DB scheme the client may lose out on employer contributions between transfer and retirement. They may also lose out on any additional incentives provided to active/pensioner members of the scheme (non-pension e.g. discounts, concessions, Death in Service or memberships?)

Assessing a transfer

The first step in assessing a transfer is to request a "Statement of Entitlement" from the Scheme Administrators. The member can usually request one of these in each 12 month period free of charge. This will provide details of the current benefits payable and the transfer value. The Pension Transfer Specialist adviser must help their client to analyse this, along with their personal needs and financial circumstances. Then, they must carefully document and help the client consider the costs of moving, the potential benefits lost by moving, etc. Only then can they advise the client whether to move from the scheme.

One development worth pointing out here is that PS18/20 introduces the FCA requirement on firms to provide a suitability report regardless of whether or not a transfer is recommended. FCA believe advising a client it is not in their interests to transfer, and setting out the considerations in reaching this conclusion, needs to be fully documented – although perhaps not as detailed as a suitability report that does recommend a transfer should proceed.

The calculation of transfer values is covered in the Transferring a pension scheme article.

The Occupational Pension Scheme (Disclosure of Information) Regulation 1996 as amended The Occupational and Personal Pension Schemes (Disclosure of Information) (Amendment) Regulations 2015

Insistent client

The FCA has published a factsheet – Pension reforms and insistent clients – providing a reminder of their position on insistent clients, given the pension reforms.

It’s important to note that under these rules it is still the responsibility of the firm to determine how (and if) they should proceed with clients who don’t take the advice given.

The FCA did highlight in PS20/6 that, firms should already be following the Handbook guidance about insistent clients in COBS 9.5A. Firms could also face claims for redress and FCA action if they behave in a way that could be interpreted as having contributed to the client’s decision to become insistent. The FCA will be monitoring insistent client transactions through the data they collect.

TVC

The Transfer Value Comparator (TVC) became effective from 1 October 2018

As part of the APTA (which is mostly left to the advisers discretion as to how best to show the analysis to put the client in an informed position) there will be a mandatory TVC. It is worth noting that the rate of return is not based on the clients likely investment performance. Instead this is based on a “risk free” return from gilts to match the “risk free” nature of the DB income. Firms must follow the assumptions that are laid out in COBS19 Annex 4 so that the analysis cannot be gamed.

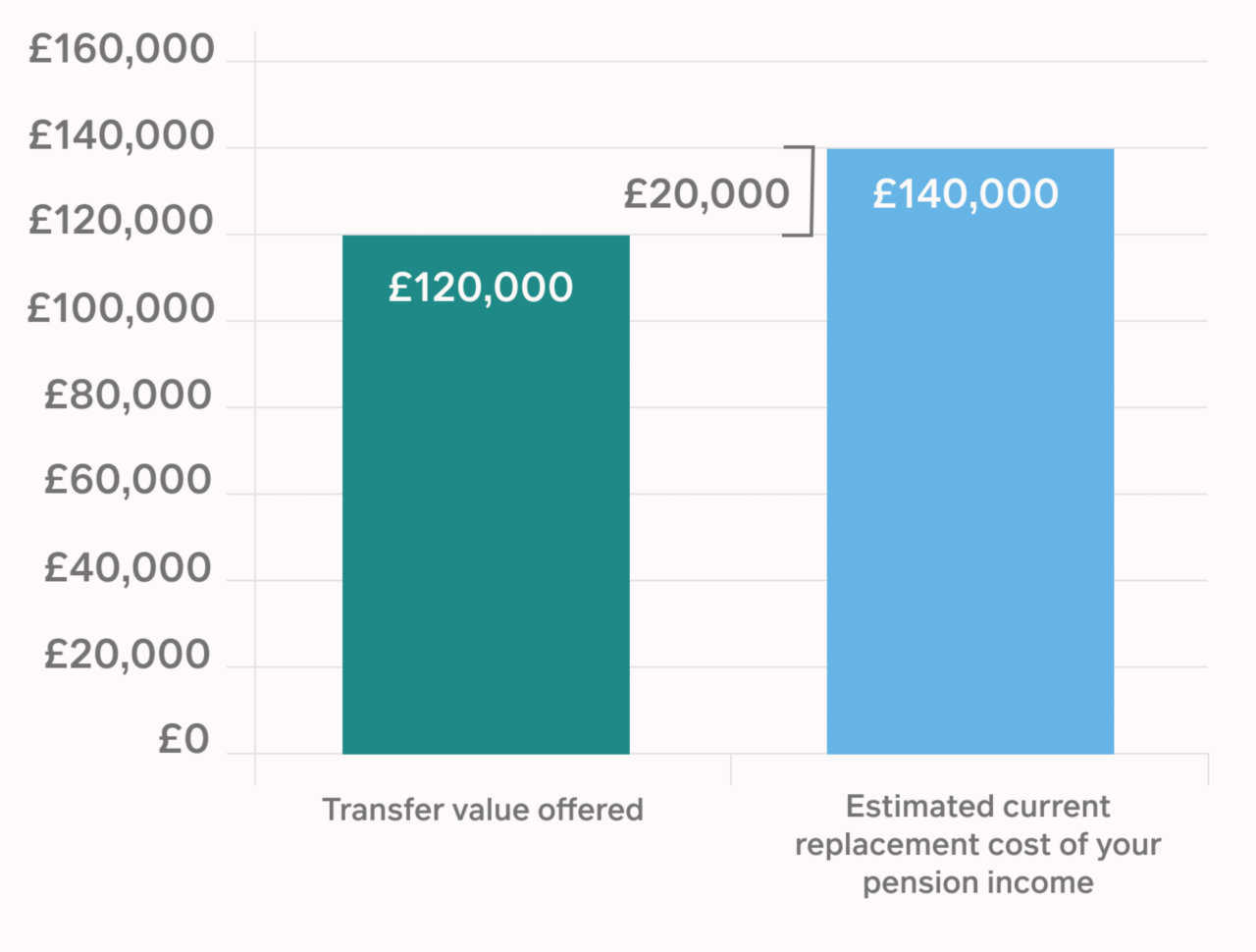

It must be displayed in the following format;

Will I be better or worse off by transferring?

- We are required by the Financial Conduct Authority to provide an indication of what it might cost to replace your scheme benefits.

- We have done this by looking at the amount you might need to buy the same benefits from an insurer.

It could cost you £140,000 to obtain a comparable level of income from an insurer.

This means the same retirement income could cost you £20,000 more by transferring.

This means advisers no longer have to explain a critical yield from a TVAS, instead they must fully inform the client of;

- the difference between the CETV value and the TVC value,

- the present discounted value of future cash flows, and

- the expected growth rate being on a “no risk” basis (as it may be unlikely that a client would invest in gilts over the medium to long term).

TVC is only one element of the APTA to put the client in a suitably informed position. It’s primary purpose is to help the customer understand the value of the guaranteed income stream and prevent “hyperbolic discounting”.

Charging

As of 1 October 2020 contingent charging for pension transfers and conversions has been banned, transitional arrangements allowed cases where work began before this date to still contingently charge, provided the personal recommendation was given before 1 January 2021.

This ban prevents a cross-subsidy in the advice process, although cross subsidy will exist as implementation must be included in the fee for advice whether the transfer goes ahead or not (the FCA admit this will create a cross-subsidy but feel that this will only be a small cross-subsidy).

Firms must charge at least as much in relation to pension transfer advice as if they were offering investment advice on funds of the same value. This is to prevent firms from gaming the ban by charging a token fee for initial advice. Advice on pension transfers and conversions is generally more complex than other investment advice, and so should typically cost the same or more than other investment advice.

There are however 2 significant carve-outs that are exempt from the contingent charging ban, a serious financial difficulty carve-out and a serious ill-health carve-out. For both carve-outs, firms need to show that the client is unable to pay for full transfer advice.

To assess ability to pay for full advice, firms should review copies of statements from all of the client’s material accounts and investments. The FCA consider consumers who are claiming certain benefits are more likely to have no capacity to pay for advice. These include Universal Credit, Job Seekers Allowance, Employment Support Allowance, Income Support, Housing Benefit and Pension Credit.

Where relevant, consumers should be able to prove they are receiving benefits. The carve out cannot be used if a client has available funds to pay for the advice but would prefer not to use their savings/income for this purpose. For these purposes, the availability of credit does not count as available funds.

Serious financial difficulty carve-out

For the serious financial difficulty carve-out, firms should evidence that the client has been unable to maintain payments on a mortgage/rent, debt repayment, council tax or utility bills for at least 3 of the past 6 months. It’s likely the client has documented debts and analysis of their current expenditure should show they have cut out all non-essential spending.

In most cases, the client should be no younger than 54.5 as a transfer would be unable to meet their need if it proceeded, as they would not be able to access the funds on transfer. But if a client is eligible to take benefits earlier from the ceding scheme and this would still be the case on transfer, then they would be eligible for the carve-out. For example, this may apply if there is a protected retirement age that could be maintained via a buddy transfer. It would also apply if the member is eligible for ill-health retirement or a serious ill-health lump sum. You would likely have gathered this information as part of the know your client process, as your client’s current financial situation is relevant to the suitability of advice.

Serious ill-health carve-out

For the serious ill-health carve-out, firms need to show the client has a medical condition which is likely to reduce life expectancy below age 75 and they do not have the ability to pay for advice. You do not need to consider future medical advances. It is likely firms would have gathered this information as part of the know your client process, as life expectancy and your client’s current financial situation is relevant to the suitability of advice. The medical evidence could include the client’s medical records which they are entitled to access free of charge. It could also include information they already hold about appointments or prescriptions. You may also take into consideration information generally available from reputable organisations and charities. For more severe conditions, the FCA think it is likely a client will be receiving specialist care and a consultant is more likely to give a diagnosis. Their records and clinical reports should reflect the details and severity of the client’s condition. For terminal conditions, a DS1500 form, used to claim benefits when terminally ill, will confirm the diagnosis and life expectancy of a patient.

Tech Matters

Ask an expert

Submit your details and your question and one of your Account Managers will be in touch.